Loan options can significantly impact your financial journey, especially when considering mortgages or personal loans in the Rio Grande Valley. As you navigate through the distinct advantages and drawbacks of fixed and variable rate loans, it’s important to understand how each option aligns with your financial goals and risk tolerance. This guide will help you explore these loan types, providing you with the information you need to make informed decisions that suit your unique circumstances.

Understanding Loan Types

A comprehensive understanding of loan types is important when navigating the financial landscape, especially in the dynamic Rio Grande Valley. You’ll encounter two primary loan structures: fixed rate and variable rate loans. Each option serves different financial strategies and goals, so it’s crucial to evaluate them according to your unique situation.

- Fixed Rate Loans: Interest rate remains the same throughout the loan term.

- Variable Rate Loans: Interest rate can fluctuate based on market trends.

- Loan Term: Can range from short-term to long-term depending on the type.

- Monthly Payments: Can be predictable with fixed loans or may vary with variable loans.

- Financial Goals: Your long-term financial objectives will impact your loan choice.

Knowing the characteristics of each loan type will enable you to make well-informed decisions regarding your financing needs.

| Aspect | Fixed Rate Loans |

|---|---|

| Interest Rate | Fixed for the term of the loan |

| Payment Stability | Stable monthly payments |

| Risk | Less risk from market fluctuations |

| Loan Duration | Commonly 15 to 30 years |

| Best For | Those seeking predictability in payments |

Definition of Fixed Rate Loans

The fixed rate loan is a traditional financing option where the interest rate remains constant throughout the term of the loan. This means your monthly payments will not change, making it easy for you to budget your finances effectively. Regardless of market interest rate fluctuations, your rate is locked in when you sign your loan agreement.

Fixed rate loans are particularly appealing for long-term financial planning. Since your payment structure stays the same, you can foresee your financial obligations with greater clarity. This predictability means you won’t face the uncertainty of a changing payment if economic conditions worsen.

Definition of Variable Rate Loans

An alternative to fixed rate loans, variable rate loans feature an interest rate that can change over time, often tied to an underlying index or benchmark. This means your monthly payments can fluctuate depending on market conditions. While you may start with a lower interest rate compared to fixed loans, it’s important to consider the potential risks associated with shifting rates.

Variable rate loans often include an initial fixed period where the rate is stable, after which it can adjust periodically. For example, you might enjoy a lower initial rate for the first five years before it adjusts annually, reflecting current market rates. Thus, your financial strategy should factor in the potential for increased payments over time.

Another critical factor to consider is the potential for substantial savings during the initial fixed period of a variable rate loan, often lowering your monthly payments significantly. However, the possibility of your interest rate rising—as economic conditions change—can translate into higher costs down the road, making this an important consideration in your decision-making process.

Key Differences Between Fixed and Variable Rates

The key differences between fixed and variable rate loans largely revolve around stability and predictability versus flexibility and potential variability. With fixed loans, your payments will always be the same, granting you peace of mind in managing your personal finances. Conversely, variable rate loans introduce an element of uncertainty since market shifts can lead to fluctuating payments.

People often choose fixed rate loans while in a stable financial position but may opt for variable rate loans if they anticipate falling interest rates or have short-term financial needs. Your comfort level with risk and your understanding of market trends will heavily influence which option best suits you.

This structured overview allows you to gauge the benefits and limitations of each loan type effectively, ensuring that you’re equipped to make informed choices. Understanding these aspects is important for aligning your financing needs with your financial goals, ultimately guiding you toward successful financial outcomes.

Benefits of Fixed Rate Loans

You may find that fixed rate loans offer a variety of benefits that can help you achieve financial stability. One of the most significant advantages is the predictability it provides in your monthly budget. With fixed rate loans, your interest rate and monthly payments remain constant throughout the loan term, allowing you to plan your finances without unexpected increases in payment amounts. This can be particularly beneficial if you are considering potential expenses related to maintaining a home. If you are looking into options like Home Equity Loans in Texas, understanding the predictability of fixed rates can help you manage your costs more effectively.

Predictability in Monthly Payments

On a fixed-rate mortgage or personal loan, you will always know exactly how much you need to pay each month, making it easier to budget and manage your finances over time. This aids in financial planning and reduces stress, especially when unexpected expenses arise. You won’t have to worry about fluctuating monthly payments based on market rates, which can be particularly helpful if you have a fixed income or prefer to keep your expenses predictable.

Protection Against Interest Rate Fluctuations

Any consumer considering a loan should recognize the benefits of fixed rates in the context of interest rate fluctuations. With a fixed-rate loan, you lock in your interest rate at the time of borrowing, so even if market rates increase in the future, your rate will remain unaffected. This is particularly crucial in today’s economy, where interest rates can change rapidly based on economic conditions. Knowing that your monthly payment will not increase provides peace of mind as you plan your financial future.

Monthly payments that remain stable can greatly aid in maintaining your financial security. If you take out a fixed-rate loan when interest rates are low, you can enjoy those low payments for the life of the loan, despite the possibility of higher rates down the line. This can lead not only to budget predictability but can also amount to significant savings over the loan’s life compared to variable-rate loans that could rise sharply.

Ideal Scenarios for Fixed Rate Loans

For many borrowers, fixed rate loans are ideal in several situations. For instance, if you plan to stay in your home for an extended period, locking in a low interest rate can save you thousands of dollars over the life of the loan. Moreover, those financing a significant purchase or undertaking a major home renovation may appreciate the stability and predictability that fixed payments provide. Fixed rate loans are also appealing in a rising interest rate environment, allowing you to secure favorable terms before rates increase.

With fixed rate loans, you’re vitally choosing security over uncertainty. In volatile economic climates or when facing financial challenges, knowing your monthly payment will remain the same can be incredibly valuable. You can confidently allocate your income for other vital expenses without the worry of increased financial pressure from rising loan payments.

Benefits of Variable Rate Loans

Potential for Lower Initial Rates

All borrowers often find the allure of variable rate loans is their potential for lower initial rates compared to fixed-rate lending options. Loans that feature variable interest rates typically start with a lower rate than their fixed counterparts. This can lead to significant savings in the early years of your loan term, making it easier for you to allocate funds to other investments or pay down additional debt. If you are looking to maximize your financial situation in the short term, this can be an attractive feature.

Additionally, the lower initial rates can translate into reduced monthly payments, which means more disposable income for you. This financial flexibility can be particularly beneficial if your income fluctuates or if you plan to make significant purchases in the near future. By choosing a variable rate loan, you may find that your cash flow remains more manageable, allowing you to maintain a higher quality of life while investing in other areas that could yield returns.

Flexibility in Payment Structures

One of the key advantages of variable rate loans is their flexibility in payment structures. Loans with variable rates often allow for more adaptable terms that can change over time, fitting your financial needs as they evolve. For example, you might have the option to make interest-only payments for a certain period, providing you with a lower monthly payment until your financial situation stabilizes or improves. This can be particularly helpful in managing cash flow during transitional phases in your life.

Potential borrowers should understand that the flexibility of payment structures with variable rate loans can also help you take advantage of market conditions. As interest rates fluctuate, your payments may adjust accordingly, allowing you to potentially benefit from a lower rate when market conditions favor it. This adaptability can make your financial planning more dynamic, enabling you to react to shifts in the economic landscape while ensuring you stay on top of your financial commitments.

Ideal Scenarios for Variable Rate Loans

Variable rate loans can be a perfect fit in specific scenarios, particularly for borrowers who plan to sell or refinance before the interest rates might adjust significantly. Variable rates are often ideal for individuals who expect their income to rise or anticipate their financial situation to improve over time, as this can help mitigate the risks associated with potential rate hikes in the future. If you are comfortable with a level of uncertainty and have a clear strategy in mind, a variable rate loan can suit your long-term financial goals.

Loans that feature variable rates are especially beneficial if you are securing financing in a low-rate environment with the expectation that rates may not rise dramatically in the short term. This configuration can allow you to capitalize on the lower initial rates without holding onto the debt for a prolonged period. Thus, understanding your financial landscape and future goals is crucial in deciding whether a variable rate loan suits your unique situation.

Analyzing the Current Market in the Rio Grande Valley

Keep in mind that understanding the current market in the Rio Grande Valley is crucial for making informed decisions when it comes to your loan options. The region has witnessed various economic developments which can significantly influence interest rates and lending practices. By keeping an eye on these factors, you can better navigate which loan type—fixed or variable—may best suit your financial situation.

Economic Overview of the Rio Grande Valley

Overview of the economic landscape in the Rio Grande Valley reveals a mix of opportunities and challenges. The area’s economy has been bolstered by industries such as agriculture, healthcare, and manufacturing. As job growth continues to rise, consumer confidence in the market has improved, positively impacting property values and, subsequently, loan demand. Additionally, local investment in infrastructure has made the region a more attractive place for businesses and residents alike.

This upward economic trajectory has fueled a competitive real estate market, with many buyers eager to take advantage of favorable conditions. However, economic fluctuations, such as changes in commodity prices and shifts in the job market, may also create uncertainties that can affect how you choose to finance your home in this ever-evolving landscape.

Current Trends in Loan Rates

Overview of current trends in loan rates indicates a noteworthy shift in the financial landscape of the Rio Grande Valley. Borrowing costs have seen fluctuations influenced by national monetary policy moves, inflation, and local economic conditions. A careful analysis of these trends is crucial because they not only influence your monthly payments but also your long-term financial health.

To help you navigate these trends, you’re likely to notice that both fixed and variable rates have their unique advantages in the current climate. For instance, while fixed rates alleviate the anxiety of rising interest rates over time, variable rates can initially offer lower costs. Understanding where your financial situation stands will help you determine which option aligns best with your goals.

Regional Considerations Impacting Loan Choices

Current regional considerations greatly influence the loan choices you face in the Rio Grande Valley. The area’s unique demographics, including a young population and diverse workforce, create an environment ripe for growth. Understanding local market conditions, like property demand and availability, will provide you with insight into potential rate changes and lending opportunities suited to your circumstances.

Valley residents should also consider how local economic drivers, such as agriculture and trade, impact financial institutions’ lending practices. For example, lenders may tailor their offerings based on seasonal fluctuations in income related to agricultural cycles. By being aware of these regional influences, you can make strategic decisions on whether a fixed or variable-rate loan better suits your financial needs.

Factors to Consider When Choosing a Loan

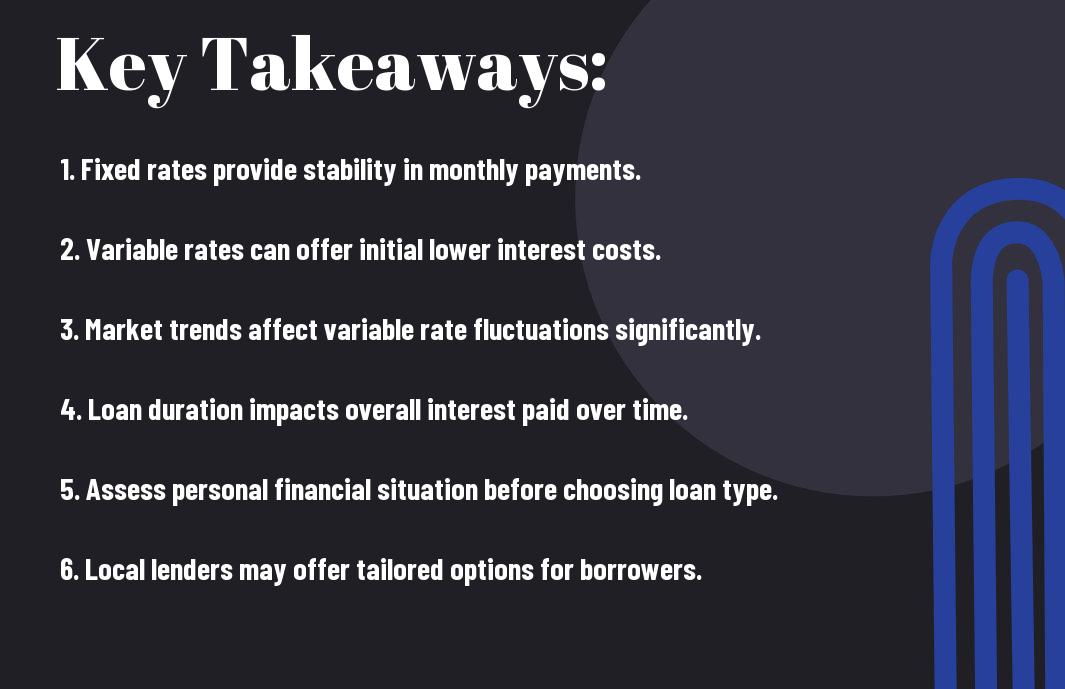

Despite the numerous options available in the Rio Grande Valley, selecting the right loan involves careful consideration of various factors. Understanding these factors can ensure that you make a decision that aligns with your financial goals and lifestyle. When exploring fixed and variable rate loan options, consider the following:

- Your personal financial situation

- The duration of the loan and your future plans

- Your risk tolerance

Perceiving these elements can significantly impact your loan experience and overall financial health.

Personal Financial Situation

Any decision regarding a loan should start with an honest assessment of your personal financial situation. Analyze your current income, expenses, debts, and savings. If you have a stable income and feel confident in your ability to manage fixed payments, a fixed-rate loan may be a great option. However, if your financial circumstances are subject to change, you might want to consider a variable-rate loan that could offer lower initial payments.

Additionally, understanding your credit score is crucial. A high credit score may qualify you for better interest rates, which can make a significant difference in your overall loan costs. Ensure you also factor in your future earning potential and how it may influence your ability to repay the loan.

Duration of Loan and Future Plans

Financial decisions regarding the duration of your loan and your future plans can drastically affect your financial landscape. Consider how long you intend to stay in the property; if you anticipate moving within a few years, a variable-rate loan might be appropriate due to its initial lower rates. However, if you’re planning to remain long-term, a fixed-rate loan provides stability and predictability in your monthly payments.

Choosing the loan duration that aligns with your future plans can mitigate the risks associated with fluctuating interest rates while also maximizing your potential benefits. Understanding your long-term goals, whether they involve upgrading to a larger home or downsizing, will inform your choice and help ensure your loan supports your lifestyle choices.

Risk Tolerance

Loan options also vary significantly according to your risk tolerance. Some individuals are comfortable with the potential fluctuations of variable rates, especially if they’re willing to accept the possibility of increasing rates in exchange for lower initial payments. On the other hand, if you’re risk-averse and prefer financial predictability, a fixed-rate loan may better suit your preferences.

Plans that prioritize stability and security are critical indicators of your risk tolerance level. Knowing your comfort with market volatility and financial uncertainty will help you determine the loan type that best aligns with your overall financial strategy.

Strategies for Securing the Best Loan Terms

Now that you are on your way to securing a loan, it’s vital to utilize effective strategies that will enable you to obtain the best loan terms possible. Understanding the nuances of fixed and variable rate loans will not only prepare you for discussions with lenders but will also empower you to make informed decisions throughout the process.

Researching Lenders and Offers

Terms and offers from various lenders can vary significantly, which is why conducting thorough research is key. Begin by comparing interest rates, fees, and repayment terms across different financial institutions. Use online calculators to get a better sense of how different loan terms will affect your monthly payments and overall financial commitments. Gathering this information allows you to understand the landscape and identify which lenders might offer you the best solution tailored to your financial situation.

In addition to comparing offers, you should also consider seeking reviews and testimonials from other borrowers. This firsthand insight can give you a clearer picture of a lender’s customer service, transparency, and overall performance. By taking the time to conduct this research, you equip yourself with the understanding needed to engage with lenders confidently and make sound decisions regarding your loan options.

Importance of Credit Score

Lenders will heavily weigh your credit score when determining the terms of your loan. A higher score indicates greater financial responsibility, which may lead to more favorable loan terms, such as lower interest rates. Conversely, a lower credit score can limit your options or result in higher rates, costing you more over time. It’s beneficial to review your credit report and address any inaccuracies before applying for a loan, ensuring you present your best financial self.

With a strong credit score, you not only have the potential for better loan terms but also improved chances of approval. Maintaining a healthy score requires timely payments, a reasonable debt-to-income ratio, and awareness of any factors that could negatively impact your creditworthiness. Be proactive in managing your credit to enhance your position when approaching lenders.

Negotiation Techniques

To maximize your chance of securing favorable loan terms, it’s critical to adopt effective negotiation techniques. Begin by clearly articulating your financial needs and the research you’ve conducted on competing offers. This sets the stage for a productive conversation between you and the lender. Being prepared to discuss your creditworthiness and other financial details not only boosts your confidence but also reinforces your position in the negotiation process.

Another key strategy involves being open to leveraging competing offers. If you receive favorable terms from one lender, use that information as leverage when negotiating with others. Additionally, don’t shy away from asking for flexibility on terms, whether it’s a lower rate or a reduction in fees. Assertiveness combined with a polite demeanor can often lead to unexpected concessions from lenders.

The ability to negotiate effectively is an art that comes with practice and preparation. Keep details at your fingertips, including comparable loan offers and an understanding of market rates. The more informed you are, the more respect you command from lending professionals, increasing your potential to walk away with more advantageous loan terms.

Conclusion

From above, it is evident that both fixed and variable rate loan options can play significant roles in your financial planning, particularly in the diverse and dynamic market of the Rio Grande Valley. With the unique economic landscape of the region, understanding the advantages and disadvantages of each type of loan is crucial for making informed decisions that align with your personal financial goals. By carefully assessing your long-term plans, risk tolerance, and current market conditions, you can choose a loan type that best suits your needs and lifestyle.

Additionally, as you navigate through the various lending options, don’t hesitate to seek assistance from local financial advisors or mortgage experts. They can provide valuable insights tailored to your specific situation. For further information on securing the right home loan tailored to your needs, consider exploring the resources available From the Panhandle to the Rio Grande Valley. This knowledge will empower you to make choices that support a brighter financial future in your community.

FAQ

Q: What are fixed-rate loans and how do they work in the Rio Grande Valley?

A: Fixed-rate loans are types of loans where the interest rate remains constant throughout the entire term of the loan. This means that your monthly payments will not change, providing predictability in budgeting. In the Rio Grande Valley, these loans are popular among homebuyers who prefer stability and want to avoid the risk of fluctuating interest rates. Fixed-rate loans typically come in terms of 15 to 30 years, and borrowers can lock in a rate at a specific point in time, protecting against future interest rate increases.

Q: What are variable-rate loans and when should I consider them?

A: Variable-rate loans, also known as adjustable-rate loans, have interest rates that can change over time based on market conditions. These loans usually start with a lower initial interest rate compared to fixed-rate loans, which can make monthly payments more affordable at the beginning. However, after an initial period, the rate and payments may increase, depending on interest rate index changes. In the Rio Grande Valley, a variable-rate loan may be suitable for those who plan to move or refinance before rates potentially increase, or for those who can afford to take on the risk of changing payments.

Q: What factors should I consider when choosing between fixed and variable-rate loans?

A: When choosing between fixed and variable-rate loans, consider your financial situation, long-term plans, and risk tolerance. If you plan to stay in your home long-term and prefer stability in your payments, a fixed-rate loan may be ideal. However, if you’re looking to save on interest and are prepared for potential fluctuations in payment amounts, a variable-rate loan may be beneficial. Additionally, consider the current interest rate environment – if rates are expected to rise significantly, locking in a fixed rate now could save you money in the long run.

Q: Are there any specific lending options available in the Rio Grande Valley for fixed and variable-rate loans?

A: The Rio Grande Valley offers several lending options for both fixed and variable-rate loans. Local banks, credit unions, and mortgage brokers can provide a variety of loan products tailored to your needs. Some lenders may also offer federal programs for first-time homebuyers that include both fixed and variable-rate loan options. It’s important to shop around and compare terms, rates, and closing costs across different lenders to find the best deal that suits your financial goals.

Q: How can I find a lender that specializes in fixed and variable rate loans in the Rio Grande Valley?

A: To find a lender that specializes in fixed and variable-rate loans in the Rio Grande Valley, start by conducting online research for local banks and mortgage companies. Websites like Zillow, LendingTree, or Bankrate may provide reviews and insights into lenders’ offerings. You may also consider asking friends, family, or a real estate agent for recommendations based on their experiences. Once you have a list, reach out to potential lenders to discuss your options and request personalized quotes that will help you make an informed decision.