There’s a significant opportunity for you to enhance your financial stability through long-term loans in the Rio Grande Valley. By understanding the ins and outs of these loans, you can effectively manage your finances, invest in your future, and make informed decisions that align with your personal and financial goals. This blog post will guide you through the advantages of long-term loans, how they can help you build a solid financial foundation, and tips to navigate the loan process successfully.

Understanding Long-Term Loans

Before delving deeper into the specifics of long-term loans, it’s important to grasp their fundamental nature and significance in your financial planning. Understanding how they work can empower you to make informed decisions that align with your financial objectives in the Rio Grande Valley.

Definition and Characteristics

An understanding of long-term loans starts with their definition. Long-term loans are financial instruments that provide borrowers with funds that they must pay back over an extended period, typically ranging from three to forty years. These loans often come with a fixed or variable interest rate, and the payment structure is usually designed to be manageable over a more protracted timeline compared to short-term loans.

Another characteristic that distinguishes long-term loans is their ability to facilitate significant investments, such as purchasing a home or funding education. The extended repayment period can lead to lower monthly payments, making them accessible options for individuals and families looking to build wealth over time. Importantly, these loans often require collateral, such as property or assets, which mitigates the lender’s risk and can provide you with more favorable terms.

Types of Long-Term Loans

Any exploration of long-term loans should include a discussion of the major types available. The most common types are mortgages, personal loans, and student loans, each serving different purposes but offering long-term repayment options that can be a cornerstone of your financial strategy. Here’s a breakdown of these types:

| Type | Description |

| Mortgages | Used for purchasing real estate, typically with terms of 15 to 30 years. |

| Personal Loans | Unsecured loans used for various purposes, usually with terms ranging from 3 to 7 years. |

| Student Loans | Designed to help cover educational expenses, often with repayment terms extending up to 25 years. |

| Home Equity Loans | Borrowing against your home’s value, usually with a fixed interest rate and a term of 5 to 30 years. |

| Commercial Loans | For business purposes, often requiring collateral and varied repayment timelines. |

- Thou must assess your needs before selecting the ideal loan type for your situation.

Understanding the different types of long-term loans will help you select the right option for your financial situation. Whether you plan to buy a home, pay for education, or invest in a business, each type comes with unique terms and conditions that you should evaluate carefully. Remember to consider factors such as interest rates, repayment terms, and what assets you may need to secure the loan, as knowledge is power in your financial endeavors.

- Thou should explore all available options to ensure you make a sound choice.

| Feature | Importance |

| Interest rates | Determine the total cost of borrowing over the life of the loan. |

| Collateral | Influences your eligibility and the terms of the loan. |

| Secured vs. Unsecured | These terms impact potential risk and interest rates. |

| Repayment flexibility | Can ease financial burden during the repayment period. |

| Lender reputation | Affects your overall experience, especially during repayment. |

Advantages of Long-Term Loans

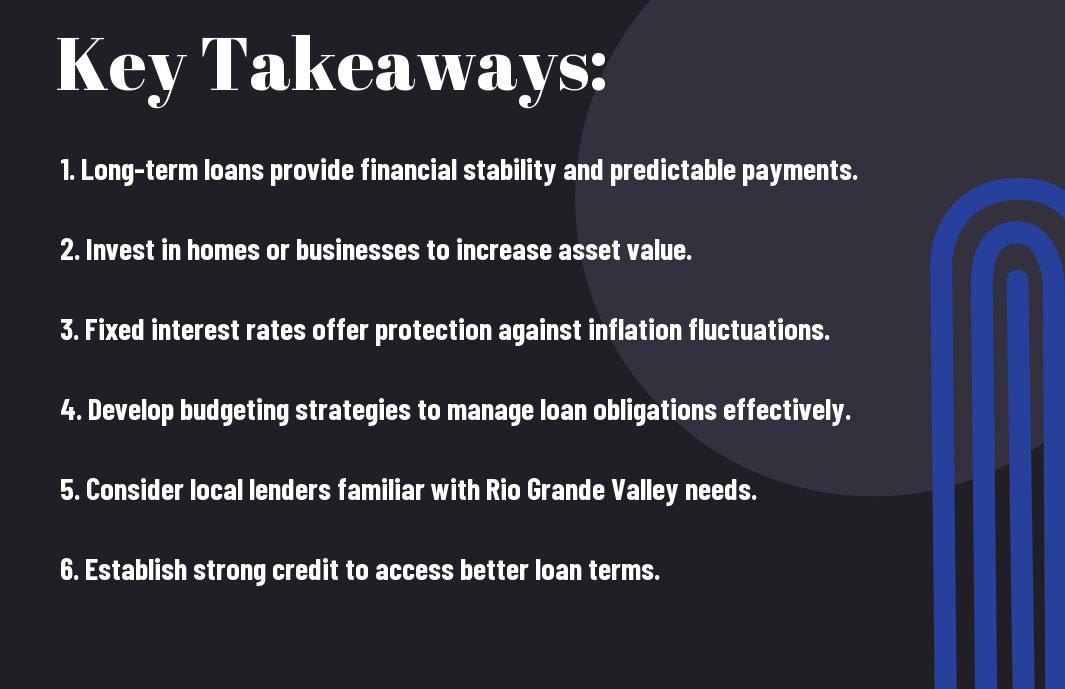

Any serious financial plan will need to consider the advantages of long-term loans. One of the most significant benefits is the lower monthly payments associated with these loans. Because the repayment period can extend for decades, spreading out the principal amount over time reduces the burden on your monthly budget, allowing you to allocate resources to other important areas, such as savings or investments.

Additionally, long-term loans can provide stability in your financial planning. Since interest rates on fixed-rate loans remain constant, you won’t face uncertain increases in your payments, which is especially beneficial in a fluctuating economic environment. This predictability can allow you to better manage your finances, ensuring that you stay on track with your long-term goals.

Understanding the advantages of long-term loans can empower you to use them strategically. For instance, well-planned long-term borrowing can lead to sustainable investment gains, whether you’re purchasing real estate or funding education. Choosing a loan with favorable terms can propel your financial situation forward, allowing you to achieve your dreams without overwhelming your budget.

Disadvantages of Long-Term Loans

Loans can offer many benefits, but they also bring potential disadvantages that you must consider. One of the most significant drawbacks is the accumulation of interest over the extended repayment period. While monthly payments may be lower, the total amount paid over the life of the loan can become substantial, ultimately leading to paying significantly more than the borrowed amount.

Moreover, long-term obligations can limit your financial flexibility. Committing to years of repayment can restrict your ability to take on new debts or invest in other opportunities. If your financial situation changes unexpectedly, you may find it challenging to meet your monthly obligations, which could negatively impact your credit score and future borrowing capacity.

Plus, the important aspects of long-term loans are crucial to understand thoroughly to make informed financial decisions. Each loan type carries specific conditions that can impact your unique circumstances, meaning that what works for one person may not work for another. A comprehensive evaluation of personal and financial goals is important for ensuring that long-term loans serve you well in the grand scheme of your financial foundation.

The Financial Landscape of the Rio Grande Valley

While navigating the financial landscape of the Rio Grande Valley, you’ll find that this region holds unique opportunities and challenges. This area is rich in culture and diversity, which can greatly influence your long-term financial decisions, particularly regarding loans and investments. For those considering entering the real estate market here, exploring McAllen, Texas Long-Term Rental Property Loans could open doors to a wealth-building avenue.

Economic Overview

On the economic front, the Rio Grande Valley has shown resilience and steady growth in various sectors, including agriculture, trade, and healthcare. The proximity to the Mexico border boosts trade opportunities, which contributes significantly to the region’s economy. Understanding these dynamics is imperative, as they can affect your ability to secure financing and the potential returns on your investments.

On a broader scale, the economic indicators in the Valley reveal a region that is still in development but ripe with potential. You will need to stay informed about local job markets and income levels to make prudent financial decisions. Additionally, keeping an eye on state and federal initiatives that may impact economic growth can be advantageous for your long-term financial plans.

Demographic Trends

Valley demographics play a crucial role in shaping the local economy and, by extension, your financial strategy. The region boasts a diverse population, with a significant number of young families and an increasing number of retirees relocating to the area. This demographic mix can influence demand for housing, consumer spending, and employment opportunities in the Valley.

Valley population growth has been robust, with an influx of new residents seeking jobs and affordable housing. You may find that this trend creates opportunities for real estate investment and rental properties, particularly in areas undergoing revitalization or development. Understanding the balance of age groups and household structures can guide you in targeting the right investments for your financial portfolio.

With a diverse range of ethnicities, incomes, and educational backgrounds, it’s crucial to analyze how these demographic factors can shape the financial opportunities available to you. As you navigate the local market, being attuned to cultural preferences and consumer behaviors can help you tailor your investments effectively.

Local Banking Institutions

Valley banking institutions are an integral part of the region’s financial landscape. Local banks and credit unions typically offer a range of financial products that cater specifically to the needs of Valley residents. Familiarizing yourself with these institutions can help you discover tailored loan products that might be more competitive than those offered by national banks.

Valley banks often focus on community lending, which means they may be more willing to consider unique financial situations that larger banks might overlook. Engaging with local banks could also provide you with community-focused financial advice and insights on regional trends that directly affect your investments.

Banking options in the region vary from larger financial institutions to smaller, community-focused banks. Each institution has its strengths, and understanding the services they offer can empower you to make informed financial choices that align with your long-term goals.

Borrowing Trends in the Region

An analysis of borrowing trends in the Rio Grande Valley reveals several noteworthy factors. As the local economy continues to grow, you may find that loan approval rates are gradually improving. This trend indicates that financial institutions are becoming increasingly optimistic about the region’s economic prospects, translating to favorable lending conditions.

An additional aspect to consider is the types of loans becoming popular within the Valley. Long-term loans are gaining traction among residents looking to invest in real estate or other ventures. These loans offer a stable foundation for financial planning and allow you to take advantage of the evolving market conditions.

This growing tendency toward long-term borrowing is reflective of a broader national trend, where individuals are increasingly seeking stable financial solutions. As you explore investment opportunities in the Rio Grande Valley, keeping an eye on these trends will help you position yourself to take full advantage of the available financing options. Understanding the overall borrowing landscape in this region can inform your approach to securing the necessary funding for your financial aspirations.

Building Creditworthiness

Once again, establishing a strong financial foundation is crucial, especially when considering the long-term impact of loans on your creditworthiness in the Rio Grande Valley. As you navigate your financial journey, Building a Solid Financial Foundation requires understanding how your creditworthiness is assessed and improved. Your credit score acts as a financial compass, guiding lenders’ decisions about your potential loan approval and interest rates.

Importance of Credit Scores

With a solid credit score, you can access better loan terms and lower interest rates, potentially saving you a significant amount of money over time. Credit scores generally range from 300 to 850, with higher scores indicating better creditworthiness. Regularly monitoring your credit score is vital, as it can affect your financial opportunities, whether you’re applying for a mortgage, an auto loan, or credit cards.

In the Rio Grande Valley, where economic conditions can vary, a strong credit score not only helps you secure loans at favorable terms but also adds to your overall financial credibility. It signals to lenders and businesses that you are a responsible borrower, which may lead to better service and more attractive offers when you engage in financial transactions.

Steps to Improve Your Credit Score

On your journey to enhancing your credit score, several actionable steps can lead to significant improvements over time. The first step is to pay your bills on time, as payment history accounts for a substantial portion of your credit score. This simple practice can help demonstrate your reliability as a borrower and positively influence your score.

Furthermore, reducing your credit utilization ratio, which is the amount of credit you are using compared to your total available credit, can also elevate your score. Keeping this ratio below 30% is generally recommended to show healthy financial habits. Regularly reviewing your credit report for errors and disputing inaccuracies is another vital practice to ensure that your score reflects your financial reliability accurately.

The more you educate yourself about credit and consistently implement these strategies, the more likely you are to see your credit score improve. Set a schedule to evaluate your financial habits and make adjustments as necessary, as continuous improvement is key to achieving strong creditworthiness.

Understanding Credit Reports

Credit reports provide a detailed overview of your credit history and behavior, including your payment history, amounts owed, credit mix, and new credit inquiries. Credit bureaus compile this information from various sources, and you can request a free copy of your credit report at least once a year from each of the three major bureaus. Familiarizing yourself with the content of your credit report is vital for understanding your financial health.

As you interpret your credit report, focus on the factors contributing to your credit score. Understanding positive and negative entries allows you to address issues and leverage strengths when applying for loans. By taking a proactive approach to your credit report, you are empowered to make informed financial decisions that align with your long-term goals.

Score tracking is often underappreciated, but it serves as your score’s ongoing barometer. Regularly check for fluctuations in your score after making positive changes, and be mindful of how missed payments or increased debts may negatively affect it. This understanding can be pivotal in successfully managing your finances.

Managing Debt Effectively

The practical management of debt is vital for maintaining creditworthiness. If you find yourself with multiple loans or credit cards, consolidating your debts may simplify your payments and potentially lower your interest rates. Focus on creating a budget that allocates funds for debt repayment while still accommodating your vital living expenses. This approach will ensure that you stay on top of your payments and gradually decrease your debt levels.

Additionally, consider the snowball or avalanche methods for paying off debts. The snowball method involves paying off smaller debts first to gain momentum, while the avalanche method focuses on paying off high-interest debt first. Choose the approach that resonates with you and aligns with your financial lifestyle for effective debt management.

Credit management strategies play a significant role in your overall financial health. By actively managing your debt, you can enhance your creditworthiness and set the stage for a bright financial future in the Rio Grande Valley.

Choosing the Right Long-Term Loan

Now that you’ve decided to pursue a long-term loan in the Rio Grande Valley, the next step is choosing the right loan for your financial situation. Selecting the most suitable loan requires careful evaluation of various loan options available to you. This process will help ensure that you secure terms that align with your financial goals, whether it’s for purchasing a home, financing education, or consolidating debt. Taking the time to evaluate your options will not only save you money in the long run but also put you in a stronger financial position.

Evaluating Loan Options

On your journey to finding the ideal long-term loan, you should begin by gathering information on the types of loans available. Different lenders will offer specific products such as conventional loans, FHA loans, VA loans, and other tailored solutions that meet various needs. Understanding the differences between these options will empower you to make a more informed decision. Factors such as loan duration, down payment requirements, and eligibility criteria can significantly impact your overall experience and satisfaction.

Interest Rates and Fees

One crucial aspect of evaluating your loan options is understanding the interest rates and fees associated with them. Rates can vary substantially from lender to lender, and even a small difference in the interest rate can lead to significant cost savings over the life of the loan. Furthermore, it’s crucial to be aware of additional fees—such as origination fees, closing costs, and any prepayment penalties—which can inflate your total borrowing costs and affect your budget.

For instance, if you secure a long-term loan with an interest rate of 4% instead of 5%, you could save thousands of dollars in interest payments over the loan’s duration. Additionally, understanding the fee structure can help you better evaluate the comparative costs of different lenders, giving you a clearer picture of your potential financial commitments.

Fixed vs. Variable Rate Loans

Choosing between fixed and variable rate loans requires careful consideration of your financial strategy. Fixed-rate loans provide you with stability, as your interest rate remains constant throughout the loan’s term, making it easier to budget your monthly payments. This predictability is especially beneficial if you anticipate long-term residence or hold a specific financial plan. On the other hand, variable-rate loans offer lower initial rates, but these can fluctuate over time, potentially leading to higher payments down the line when market conditions change.

Variable rates come with the potential for both risks and rewards; while you may benefit from lower payments during periods of stable or declining interest rates, there’s the possibility of increasing payments if rates rise, which could strain your finances. Carefully assess your risk tolerance and future financial outlook before committing to either option.

Loan Terms and Conditions

Interest in the terms and conditions of your loan is crucial as these elements define your borrowing experience. Loan terms typically range from 10 years to 30 years, and you’ll want to evaluate which duration suits your financial goals best. Shorter terms often mean higher monthly payments but lower total interest costs, while longer terms ease immediate financial pressure but may lead to higher interest expenses in the long-term.

Right from the outset, it is crucial to read and understand the loan agreement in its entirety. Look out for clauses that may impose unexpected financial obligations, such as prepayment penalties or conditions for refinancing. Understanding these terms helps ensure that you are making a sound financial decision that won’t lead to complications in the future.

Strategies for Effective Loan Management

Keep in mind that effective loan management is crucial to maintaining your financial stability, especially when utilizing long-term loans in the Rio Grande Valley. A solid strategy not only ensures that you meet your repayment obligations but also minimizes the stresses that come with owing money. This chapter will explore various strategies that you can adopt to manage your loans effectively and build a robust financial foundation.

Budgeting for Loan Payments

Management of your loan payments begins with a well-thought-out budget. You should start by calculating your monthly income and listing all your expenses, including those that are vital and discretionary. By doing so, you can allocate a specific portion of your budget to your loan payments, ensuring that you prioritize this financial obligation. It’s vital to reevaluate your budget regularly, especially if you experience any changes in your income or expenses, so that you can adjust your loan payment allocations accordingly.

In addition, consider creating a savings buffer within your budget to account for any unexpected expenses or fluctuations. This will help you avoid falling behind on your loan payments if an emergency arises. Keep in mind, having a clear view of your financial landscape will enable you to make informed decisions regarding both spending and repayment strategies, which ultimately supports your long-term financial health.

Prepayment Strategies

Strategies for prepayment can significantly lighten your loan burden over time. If your loan agreement allows it, consider making extra payments toward the principal when you have additional funds available. By doing so, you reduce the overall interest you will pay over the life of the loan and potentially shorten the duration of your debt. Before proceeding with this strategy, ensure that there are no prepayment penalties or restrictions imposed by the lender.

Understanding how prepayment impacts your loan is paramount. Many lenders apply your extra payments directly to the principal, which can significantly accelerate the pay-off timeline. It’s also beneficial to communicate regularly with your lender to clarify how your prepayments will be applied and to keep track of your loan balance as you chip away at your debt.

Dealing with Payment Difficulties

Payment difficulties can arise unexpectedly, and it’s crucial to address them proactively. If you find yourself struggling to keep up with your loan payments, communicate with your lender as soon as possible. Many lenders offer assistance programs or payment arrangements that can temporarily lower your payments or extend your repayment term to make it more manageable. Ignoring the issue can lead to penalties, increasing debt, and even the risk of default.

Moreover, reassess your budget and explore ways to cut costs or increase your income. Consider negotiating with your creditors for better terms or seeking financial assistance programs available in the Rio Grande Valley that can help alleviate some of the burden. The sooner you take action, the easier it will be to navigate through these challenges and regain control of your financial situation.

Refinancing Options

An excellent strategy to consider if you face challenges meeting your loan payments is refinancing. This process involves taking out a new loan to pay off one or more existing loans, often with different terms that may be more favorable to your financial situation. For example, if interest rates have decreased since you took out your original loan, refinancing could allow you to secure a lower interest rate, resulting in reduced monthly payments and overall interest costs.

For instance, if you initially secured a long-term loan with a higher interest rate, exploring refinancing options with various lenders could lead you to save a significant amount of money over time. Be sure to factor in any closing costs, fees, or penalties associated with refinancing to fully understand the financial implications. Evaluating your options and consulting with a financial advisor can provide clarity and guide you toward a decision that best fits your goals.

Long-Term Financial Planning

Despite the fluctuations in the economy and the unique challenges you may face in the Rio Grande Valley, effective long-term financial planning can set the stage for a more secure future. By establishing a clear roadmap for your finances, you create a foundation that encompasses all areas of your financial life. This includes understanding your cash flow, creating budgets, and planning for both unexpected expenses and significant life events that require financial support. A good long-term financial plan empowers you to make informed choices about debt and how you can use long-term loans to support your goals.

Setting Financial Goals

Financial goals are the benchmarks that guide your long-term financial planning. By defining clear and achievable objectives, you can measure your progress and stay motivated along your journey. These goals might include paying off debt, saving for education, purchasing a home, or securing a comfortable retirement. It’s important to differentiate between short-term and long-term goals, as this will help you prioritize your efforts and allocate your resources efficiently.

Your financial goals should be SMART—specific, measurable, achievable, relevant, and time-bound. By clarifying your intentions and timelines, you’ll clarify your focus, making it easier to assess your progress and recalibrate your strategies as necessary. Whether you’re saving for a dream vacation or preparing for a major life transition, effective goal-setting lays the groundwork for building a solid financial foundation through long-term loans and other financial tools.

Importance of Savings

With long-term financial planning, one of the cornerstones of success is establishing a robust savings strategy. Savings act as a buffer against unexpected expenses, allowing you to manage financial hardships without derailing your long-term goals. Consistently contributing to a savings account can help you accumulate funds for emergencies, opportunities, or major purchases. You’ll find that a habit of saving not only gives you peace of mind but also enhances your overall financial health.

Setting aside a portion of your income each month can create a safety net while ensuring you remain focused on your long-term objectives. Choose to automate your savings deposits for maximum efficiency. In the face of unforeseen circumstances—like medical emergencies or car repairs—having savings can spare you from incurring high-interest debt. A strong savings plan positions you not just for emergencies but also for the excitement of living life on your terms.

Diversifying Investments

Any successful long-term financial plan includes a diverse investment portfolio, which serves to minimize risk while maximizing potential returns. Diversification is crucial because relying on a single type of investment can leave you vulnerable to market volatility. You should aim to spread your investments across various asset classes, such as stocks, bonds, and real estate, which can provide stability and growth to your financial foundation.

For instance, by balancing high-risk investments with low-risk options, you cushion your portfolio against fluctuations. It’s crucial to regularly review and adjust your investment mix to align with your financial goals and risk tolerance. Engaging with a financial advisor can also provide you with tailored insights into your investment strategy, ensuring that your portfolio continues to serve your long-term financial aspirations.

Retirement Planning

To truly solidify your long-term financial foundation, you must prioritize retirement planning. This process involves estimating your future financial needs in retirement and developing a strategic plan to save and invest accordingly. Understanding the various retirement savings options, including IRAs and employer-sponsored plans like 401(k)s, is crucial to secure your financial independence when you decide to retire.

As you approach retirement age, consider how your income sources will sustain you throughout your golden years. Adequate retirement planning helps ensure that you can live comfortably and enjoy your retirement without financial constraints. The earlier you start planning for your retirement, the more you can benefit from compound interest and the power of long-term investments. Making small contributions consistently over time can make a significant difference in your retirement savings.

Planning for retirement is not just about numbers; it’s about envisioning the lifestyle you desire in your later years and understanding the steps necessary to achieve that vision. Take the time to educate yourself about the various investment vehicles available for retirement savings, and consider consulting with a financial planner to ensure you’re on the right track. By committing to thorough retirement planning, you are investing in your future, creating the freedom to enjoy the life you’ve worked hard to build.

Summing Up

So, as you navigate the financial landscape in the Rio Grande Valley, understanding the importance of building a solid financial foundation through long-term loans is crucial. These loans offer you the benefit of lower monthly payments and extended repayment periods, which can greatly improve your cash flow. By making informed choices and selecting the right type of long-term loan—whether it’s for a home, a car, or other significant investments—you’re positioning yourself to achieve greater financial stability while taking time to focus on your personal and family goals.

In addition, leveraging long-term loans strategically can help you build creditworthiness over time. As you commit to regular payments, you can enhance your credit score, making it easier for you to secure future financing options at competitive rates. Bear in mind, establishing a solid financial foundation takes time and patience; however, with the right approach to long-term loans, you can set yourself and your family up for lasting success in the vibrant community of the Rio Grande Valley.

FAQ

Q: What are long-term loans and how do they work in the context of building a solid financial foundation?

A: Long-term loans are financial products typically offered for a duration of more than five years. They are designed to provide borrowers with larger amounts of money, which they can repay over an extended period, often with lower monthly payments compared to short-term loans. In the context of building a solid financial foundation in the Rio Grande Valley, these loans can ensure that individuals and families have access to necessary funds for significant investments like purchasing a home or starting a business. By spreading payments over several years, borrowers can manage their cash flow effectively and avoid the stress of larger, short-term repayment obligations.

Q: What types of long-term loans are available in the Rio Grande Valley?

A: In the Rio Grande Valley, residents can access various types of long-term loans including mortgages, auto loans, and business loans. Mortgages can be used for purchasing homes, offering favorable interest rates and terms. Auto loans help finance vehicle purchases and often range from three to seven years. Business loans, which can be SBA loans or traditional bank loans, enable entrepreneurs to invest in their businesses for growth and expansion. Each type of loan has distinct features, interest rates, and eligibility criteria tailored to different financial needs.

Q: How can long-term loans contribute to financial stability and growth in the Rio Grande Valley?

A: Long-term loans contribute to financial stability and growth in several ways. Firstly, by enabling significant purchases like homes or vehicles, they help families build equity and establish credit history. Secondly, for businesses, long-term loans provide the necessary capital to invest in operations, which can lead to growth and job creation in the community. Finally, by allowing for manageable monthly payments, borrowers can plan and budget more effectively, reducing the risk of financial distress that often comes with debt.

Q: What should individuals consider before applying for a long-term loan in the Rio Grande Valley?

A: Before applying for a long-term loan, individuals in the Rio Grande Valley should assess their financial situation carefully. Key considerations include their credit score, which affects interest rates; monthly income and expenses to ensure affordability of payments; and overall debt-to-income ratio, which lenders often evaluate. Additionally, potential borrowers should compare loan products from multiple lenders to find the best terms, including interest rates, fees, and repayment options that align with their financial goals.

Q: Are there any local resources or programs to assist residents of the Rio Grande Valley in securing long-term loans?

A: Yes, residents of the Rio Grande Valley can access a variety of local resources and programs aimed at assisting them in securing long-term loans. Organizations such as local credit unions, banks, and the Small Business Administration (SBA) provide tailored loan products and financial education resources. Additionally, nonprofit organizations often offer workshops on credit counseling, budgeting, and navigating the loan application process. These local resources can help individuals and businesses understand their financing options better and improve their chances of securing favorable loan terms.