Many individuals in the Rio Grande Valley (RGV) seek long-term loans to fulfill various financial needs, from purchasing a home to expanding a business. Understanding the significance of collateral in this process is crucial for you as it not only enhances your chances of loan approval but also influences the terms and interest rates offered. By securing your loan with valuable assets, you can demonstrate to lenders that you are a responsible borrower, thereby fostering a stronger relationship with financial institutions while safeguarding your investment.

The Importance of Collateral in Securing Long-Term Loans in RGV

Before venturing into the intricacies of securing long-term loans in the Rio Grande Valley (RGV), it is necessary to understand collateral and its fundamental role in lending. Collateral is an asset or a group of assets that a borrower offers to a lender to secure a loan. In case you default on your loan, the lender has the legal right to seize the collateral to recover the outstanding balance. Thus, putting up collateral can not only make you more attractive to lenders but also potentially lower your interest rates and improve your borrowing terms.

Definition of Collateral

With collateral, you serve as an assurance to the lender that they will not suffer a total loss should you fail to repay the loan. The collateral you provide can significantly impact your loan’s approval process. When you present valuable assets, you are showcasing your commitment to meeting your financial obligations, thereby increasing your odds of securing the funds you need.

It’s important to remember that not all types of collateral carry the same weight. Lenders will generally assess the value, liquidity, and ease of selling the collateral. Therefore, understanding what types of assets can serve as collateral is necessary for making informed decisions about your financing strategy.

Types of Collateral

With various options available, different forms of collateral can be leveraged based on your financial situation and the nature of the loan. Common types of collateral include real estate, vehicles, equipment, and investments. Each option presents its advantages, but the crucial factor is whether the lender accepts the specific asset type for your loan.

| Type of Collateral | Description |

|---|---|

| Real Estate | Homes, lands, or commercial properties. |

| Vehicles | Cars, trucks, and motorcycles. |

| Equipment | Machinery, computers, or tools used in business. |

| Investments | Stocks, bonds, or mutual funds. |

| Inventory | Finished goods or raw materials owned by a business. |

- Real estate can typically offer the highest collateral value due to its appreciating nature.

- Vehicles are a solid choice for personal loans, given their usability and market demand.

- Equipment is favorable for business loans, as it can directly tie to cash flow generation.

- Investments can serve as liquid collateral; however, they come with market risk.

- Inventory, though valuable, might be more volatile in terms of market conditions.

Thou should consider carefully which assets you are willing to use as collateral before applying for a loan. Each type of collateral comes with its own set of risks and rewards, and understanding these can empower you in your borrowing journey.

The Role of Collateral in Lending

One of the primary roles of collateral in lending is to minimize risk for the lender. When you secure your loan with collateral, it provides the lender with an added layer of security. In the unfortunate event that you fail to repay the loan, the lender can liquidate the collateral to recoup their losses. This protective measure allows lenders to offer loans at more favorable terms, making it an advantageous situation for both parties involved.

Moreover, collateral can facilitate large loan amounts. Lenders are more likely to extend significant sums when they have something tangible to rely upon as security. The overall structure of collateral-backed loans typically leads to lower interest rates, thanks to the diminished risk of financial loss on the lender’s end.

Collateral plays a pivotal role in the lending landscape, providing both you and the lender with a safeguard during the borrowing process. It serves as both a formally recognized assurance and a tool for enhancing your loan conditions, ultimately leading to a more constructive financial experience.

Legal Framework Governing Collateral

Collateral is governed by a legal framework that varies across jurisdictions. The laws stipulate how collateral can be used, the rights of both parties in the event of default, and the process for recovering the collateral. Understanding these legal nuances is crucial as they dictate how your loan agreement is structured and enforced.

The Uniform Commercial Code (UCC), for instance, offers guidelines in the United States regarding secured transactions, including the treatment of collateral. As you engage in securing a loan, it’s advisable to familiarize yourself with the UCC and any specific regulations that may affect your collateral, particularly in RGV.

Legal frameworks surrounding collateral not only protect lenders but also respect borrowers’ rights within the confines of their agreements. Therefore, it is sensible to consult legal expertise if you are unsure how these laws may apply to your situation.

Lending practices continually evolve, and so do the legal frameworks that govern collateral. Staying informed can help you capitalize on every opportunity while protecting your financial interests in the long term.

The Long-Term Loan Landscape in the RGV

The long-term loan landscape in the Rio Grande Valley (RGV) is a vital component of the economic framework that supports both individuals and businesses. It can provide the necessary capital for large investments, such as home purchases, business expansions, or significant equipment acquisitions. Understanding this landscape requires an awareness of the myriad of loan products available, along with the specific characteristics that govern lending practices in the region. For a deeper understanding of financial dynamics, you might explore The Role of Collateral in Credit Markets.

Overview of Long-Term Loans

For individuals seeking long-term stability or businesses aiming to scale, long-term loans are designed to meet these needs. These loans typically have terms extending beyond five years and come with fixed or variable interest rates. They offer predictable monthly payments, making it easier for borrowers to manage their financial obligations over time. Additionally, such loans may require robust credit evaluations and collateral, which enhances the lender’s security while potentially lowering your interest rates.

For many, the primary appeal of long-term loans lies in their lower monthly payments compared to short-term financing. This is particularly beneficial when budgeting for significant expenditures, as the impacts of these payments can be spread out over an extended period. By understanding the characteristics and parameters of these loans, you can better navigate your options and make informed financial decisions.

Key Characteristics of the RGV Lending Market

Market trends in the RGV demonstrate a unique lending environment characterized by both opportunities and challenges. Lenders in this region typically focus on small businesses and residential mortgages, reflecting the demographic and economic profile of the area. Additionally, local lenders often emphasize personal relationships, which can be vital in securing favorable loan terms. Understanding the local economic landscape is crucial for you, as it influences lending criteria and potential tax incentives.

Market players in the RGV also face constraints that may affect loan availability. Factors such as economic fluctuations, unemployment rates, and regional population trends profoundly impact lending practices. By remaining informed about these dynamics, you can strategically position yourself to take advantage of available financing options.

Another imperative characteristic is the role of small community banks and credit unions, which often provide tailored financial solutions to meet local needs. These institutions may offer flexible terms and personalized service, which can be particularly beneficial if you are a first-time borrower or if you seek specialized lending products.

Demand for Long-Term Loans in RGV

Loan demand in the RGV reflects an increasing interest in homeownership and business development. As the region continues to grow, many residents find long-term loans appealing as they provide a pathway to financial stability. You’ll notice that homebuyers are more inclined to seek out these loans to facilitate their dream of homeownership, especially in a market where property values may appreciate significantly over time.

Loan growth is also driven by entrepreneurial spirit in the RGV, as small businesses seek long-term financing to expand operations or cover capital expenditures. This demand for long-term loans plays a pivotal role in local economic development, allowing businesses to innovate, hire, and contribute to community growth.

LongTerm projections for demand suggest that as the RGV continues to develop, the appetite for sustained financial solutions will grow. This can stem from both individuals looking to establish financial roots and businesses aiming for significant growth trajectories, which will ultimately shape the future funding landscape.

Major Lenders and Institutions in RGV

Major lending institutions in the RGV include both local banks and larger national entities that have established a presence in the area. These lenders often offer a mix of traditional long-term loans, as well as specialized products aimed at first-time homebuyers or small business owners. By understanding who these institutions are, you can make informed decisions when exploring financing options.

Major lenders typically have specific eligibility criteria, which can vary based on the type of loan you are seeking. Programs tailored for local residents and businesses can be advantageous, particularly in aligning your financial needs with those of the lending institutions in the area. It’s imperative to research their offerings and get pre-qualified to save time and effort in your search.

To fully leverage your options in the RGV lending market, you should conduct thorough due diligence on these lenders. Understanding their loan products, customer service records, and overall market position will empower you to make decisions that are best suited for your financial goals and needs.

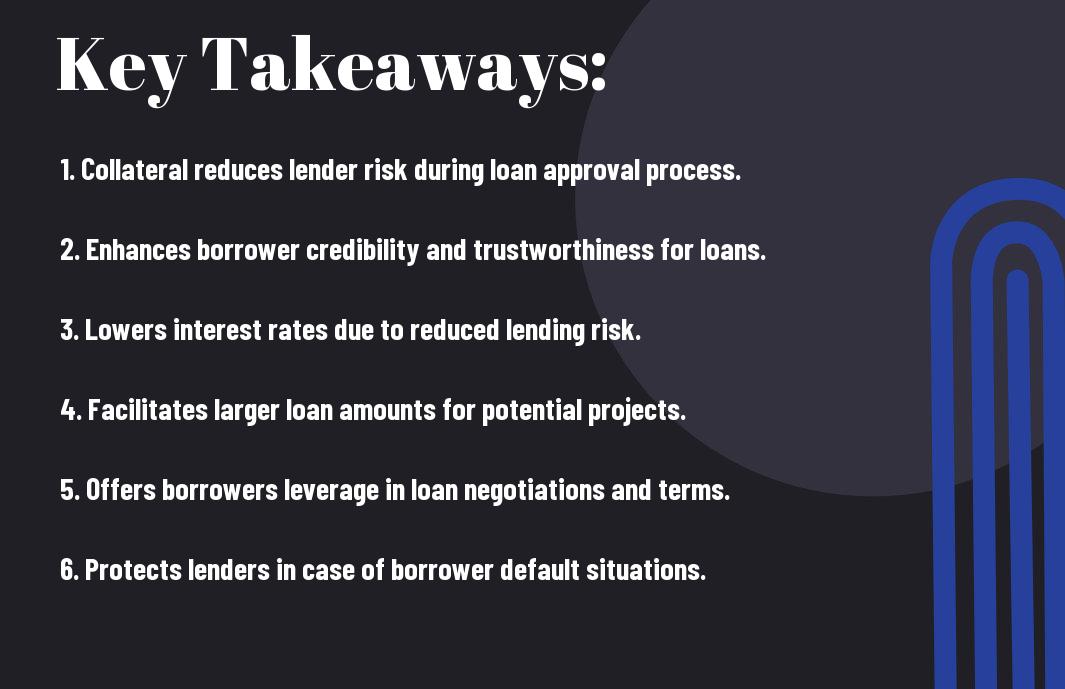

Importance of Collateral for Borrowers

To understand the importance of collateral in securing long-term loans, you should consider how it affects your borrowing capabilities. Collateral serves as a safety net for lenders, providing them with a form of security in the unfortunate event you default on your loan. By pledging an asset, such as real estate or equipment, you not only demonstrate your commitment to repaying the loan but also enhance your chances of approval. For an in-depth look at how collateral works in the context of corporate loans, be sure to check out this resource on Corporate Loans: Understanding Collateral and Security.

Risk Mitigation for Lenders

One of the primary reasons lenders require collateral is to mitigate risk. When you secure a loan with an asset, it significantly reduces the lender’s exposure to financial loss. In essence, collateral provides a level of protection because if you fail to repay the loan, the lender can repossess the collateralized asset. This arrangement encourages lenders to approve your loan application since they have assurance that they can recover their funds, which is particularly beneficial for those with less established credit histories.

By pledging an asset, you importantly lower the risk profile of your loan. This aspect becomes especially important in long-term loans, where the risk spans a more extended period. Lenders are more likely to offer financing if they believe that their investment is protected, making collateral a vital component in securing your loan.

Improved Loan Terms for Borrowers

Borrowers often find that offering collateral can lead to improved loan terms. This advantage is due to the reduced risk for lenders, who may be more willing to lower interest rates or extend longer repayment periods. With collateral in place, you can negotiate terms that are more favorable for your financial situation, allowing you to manage your loan obligations more effectively.

Plus, the assurance of having collateral can open doors to borrowing options that may have been previously unavailable to you. This possibility allows for better overall financial planning and contributes to your long-term financial health. Lenders are inclined to reward borrowers who are willing to take on the responsibility of securing their loan, creating a mutually beneficial arrangement.

Establishing Credibility and Trust

Terms dictate the relationship between you and the lender, highlighting the importance of credibility and trust in the borrowing process. When you present collateral, you not only validate your ability to repay but also demonstrate your willingness to stand behind your loan agreement. This act builds trust between you and your lender, which can lead to future borrowing opportunities and better terms on subsequent loans.

Establishing a reputation as a responsible borrower is crucial. Lenders are more likely to consider you a valuable client if you show a history of honoring your commitments, especially when secured by collateral. Over time, this relationship can culminate in easier access to additional financing and further establish your credibility in the lending community.

Enhancing Access to Larger Loan Amounts

To obtain larger loan amounts, collateral plays an indispensable role. By providing security in the form of assets, you significantly increase your chances of qualifying for higher levels of financing. Lenders feel more comfortable extending larger loans when they have collateral to back up your commitment, effectively boosting your borrowing capacity.

Collateral can serve as a powerful tool when vying for larger loans, especially if you’re planning to fund significant projects or investments. By leveraging your assets, you could potentially unlock larger amounts of capital, enabling you to pursue your financial goals more aggressively and with greater confidence.

Collateral acts as a bridge between you and financial opportunities, and utilizing it effectively can enhance your access to substantial loans, allowing you to take your ventures to the next level.

Impact of Collateral on Loan Approval Rates

After understanding the various aspects of collateral, it’s imperative to probe into how it impacts loan approval rates. Lenders often view collateral as a safety net that minimizes their risk when granting loans. When you provide collateral, it acts as a form of assurance that you will fulfill your repayment obligations. Research indicates that borrowers with collateral have a significantly higher chance of having their loan applications approved compared to those who do not offer any security.

Statistical Analysis of Approval Rates

The statistics surrounding collateral and loan approvals are compelling. Studies show that borrowers who present collateral can increase their chances of approval by upwards of 60%. This is particularly critical for long-term loans in the RGV, where lenders seek to mitigate potential risks. Having an asset to back your loan not only makes your application stronger but also shows lenders that you are serious and capable of fulfilling your financial commitments.

Factors Influencing Loan Decisions

For lenders in the RGV, several factors play an imperative role in determining loan decisions beyond collateral alone. These include your credit history, income stability, and overall financial health. By assessing these elements, lenders can gauge your ability to repay the loan while measuring the risk associated with lending to you. Key factors may include:

- Your credit score

- Debt-to-income ratio

- Employment history

- Asset valuation

- Purpose of the loan

Assume that your collateral is significant, but your credit score is low; it might still impact your chances of approval. Each factor interplays with the others to influence lenders’ final decisions.

Another critical component influencing loan decisions is the nature of the collateral itself. Lenders assess not only the value but also the liquidity of the asset you provide. For example, property rights may weigh more favorably than personal belongings like vehicles or electronics, which can depreciate rapidly. The asset’s role can significantly sway the lender’s decision on whether to approve or reject your loan request. Consider the following factors:

- Type of collateral

- Market value

- Condition of the asset

- Ownership and title issues

- Market demand for the collateral

Assume that the asset you provide is in excellent condition and highly sought after; it could increase your approval chances immensely.

Collateral’s Influence on Interest Rates

Impact on interest rates is another significant factor when considering collateral for long-term loans. When you secure a loan with collateral, lenders often offer lower interest rates compared to unsecured loans due to the reduced risk involved. This can lead to significant savings over the life of the loan, making it easier for you to manage your finances. In the context of RGV, where long-term loans might be necessary for larger investments, using collateral can make a substantial difference.

Collateral acts not only as a buffer against default but also incentivizes lenders to offer you a more favorable interest rate. This reduction can be attributed to the lender’s perceived lower risk associated with your loan. In essence, the more secure the loan appears, the better the terms you may receive.

Comparison of Secured vs. Unsecured Loans

Statistical comparisons between secured and unsecured loans can shed light on their respective benefits and potential drawbacks. Understanding the differences can guide you in making more informed financial decisions. Below is a table highlighting key aspects of these two loan types:

Comparison of Secured vs. Unsecured Loans

| Secured Loans | Unsecured Loans |

|---|---|

| Lower interest rates | Higher interest rates |

| Requires collateral | No collateral needed |

| Higher approval rates for those with poor credit | More difficult to obtain with low credit scores |

| Risk of losing collateral upon default | No asset risk if you default, but can affect credit score |

A thorough knowledge of secured and unsecured loans enables you to strategically choose based on your current situation. Understanding the implications of interest rates, approval processes, and collateral management can serve you well in attaining the best possible financial outcomes.

As you weigh your options for loans in the RGV, remember that knowing the advantages of each type can empower you to select the best fit for your financial needs. Paying close attention to factors such as interest rates and collateral can lead to more advantageous terms and ensure a smoother loan process.

Common Types of Collateral Used in RGV

Now, as you consider securing a long-term loan in the Rio Grande Valley (RGV), it is crucial to understand the various types of collateral you can use. Collateral not only helps in obtaining a loan but also enhances your credibility as a borrower. Below are some common types of collateral utilized in the RGV:

- Real Estate and Property

- Vehicles and Equipment

- Financial Assets and Investments

- Inventory and Business Assets

- Personal Property

Recognizing the best type of collateral for your needs can dramatically affect your loan terms and approval chances.

| Type of Collateral | Description |

|---|---|

| Real Estate and Property | Land and buildings that you own outright. |

| Vehicles and Equipment | Cars, trucks, machinery, or equipment used in your business. |

| Financial Assets and Investments | Stocks, bonds, and other investment accounts. |

| Inventory and Business Assets | Goods, products, or property used in your business operations. |

| Personal Property | Jewelry, electronics, or valuable collectibles. |

Real Estate and Property

Property serves as one of the most popular forms of collateral in the RGV. When you own a home, land, or commercial buildings, you can leverage these assets to secure loans. Lenders often prefer real estate because it holds its value over time and can be assessed easily. When you pledge real estate as collateral, it reduces the risk for the lender, which can result in lower interest rates and better loan terms for you.

In the event of default, the lender has the right to seize the property and sell it to recover the loan amount. This potential financial security makes real estate an attractive option, allowing you to borrow larger sums while enjoying lower monthly repayments.

Vehicles and Equipment

Property such as vehicles and equipment can also serve as valuable collateral. If you own trucks, vans, or heavy machinery necessary for your business operations, these assets can be pledged to secure financing. Lenders appreciate vehicles and equipment since they are often necessary for generating revenue, and they can be easily appraised.

Moreover, financing your vehicle or equipment through a secured loan may allow you to obtain lower monthly payments compared to an unsecured loan, as the lender is more inclined to offer favorable rates when there is collateral involved.

To maximize the potential of using vehicles and equipment as collateral, ensure that they are in good condition and have clear titles. This not only enhances their value but also boosts your credibility as a borrower, making lenders more willing to work with you.

Financial Assets and Investments

Used effectively, financial assets and investments can serve as solid collateral in securing long-term loans. This category includes stocks, bonds, mutual funds, retirement accounts, and other investment portfolios. By leveraging these assets, you can access substantial loans, depending on your total account value.

Additionally, using financial assets as collateral can be an agile way to maintain liquidity while freeing up funds for other investments or expenditures. Just be aware that lenders may place limits on the amount you can borrow against these assets, usually a percentage of their market value, to protect themselves from market fluctuations.

Assets frequently appreciate and can be more stable than other forms of collateral, making them favorable in the eyes of lenders. This financial strategy allows you to diversify your borrowing options while ensuring your investments work for you.

Inventory and Business Assets

Inventory serves as another potential form of collateral that many businesses in the RGV can leverage. If you run a retail or wholesale operation, the products you have on hand can be used to secure a loan. This strategy is often beneficial for businesses looking to increase their cash flow or fund growth initiatives.

Using inventory as collateral has its advantages; it can be turned into cash relatively quickly with a well-established customer base. However, it’s important to maintain accurate records of your inventory’s value, as the lender will likely require a detailed assessment to determine the loan amount you can secure against it.

Business inventories can fluctuate, and lenders may require periodic appraisals to ensure that the value remains stable throughout the loan period. This responsibility emphasizes the importance of effective inventory management not just for collateral but also for the overall health of your business.

Challenges and Risks Associated with Collateral

Unlike the absolute security that collateral seems to provide, there are various challenges and risks involved that you should consider before using it as a means to secure long-term loans. Although collateral acts as a safety net for lenders, market dynamics and individual circumstances can drastically affect the true utility of that collateral over time. Understanding these risks can empower you to make informed decisions when negotiating your loan agreements.

Market Fluctuations and Asset Value

Associated with collateral are the inherent fluctuations in market conditions that can lead to variances in asset value. For instance, the real estate market is often subject to sudden economic shifts, which means that the property you are using as collateral may depreciate significantly after you’ve secured your loan. This volatility can inadvertently reduce your leverage with the lender and may even result in a situation where the collateral no longer meets the requisite loan-to-value ratio, thus risking the loan’s viability.

Moreover, unexpected events such as natural disasters or economic downturns can further exacerbate these issues, rendering your collateral insufficient. You could find yourself in a challenging predicament if the market value of your asset falls below the amount you borrowed, making it vital that you carefully assess the market trends surrounding your collateral before committing to a loan.

Borrower Default Implications

Defaulting on a loan can have severe consequences, not just for your credit score, but also for your collateral. When you fail to meet debt obligations, lenders have the legal right to seize your collateral to recover their losses. This means that you could lose valuable assets that serve as security for your loan, leaving you in a precarious financial situation. Understanding the ramifications of a potential default can help you make better choices regarding your borrowing capacity and which assets to put on the line.

Collateral plays a critical role in these circumstances, as the lender will typically seek to sell the seized asset to recoup their investment. This can lead to considerable financial losses for you, particularly if the seized asset is sold at a value that is much lower than what you originally paid, which can further complicate your financial recovery.

Legal Complications in Foreclosure

Collateral comes with its own set of legal complexities, particularly during foreclosure proceedings. If you default on your loan, the lender may initiate foreclosure to reclaim the collateral. This process can be lengthy and fraught with legal challenges, potentially leading to significant delays and mounting legal fees for you. It’s crucial that you’re prepared for these proceedings because they can be both time-consuming and stressful.

Foreclosure laws can vary widely based on your location, and any misstep in the process could lead to additional complications. You might find yourself needing legal representation to navigate the intricacies of foreclosure, adding more financial burden to an already challenging situation.

Evaluating the True Value of Collateral

Any assessment of collateral value requires a thorough and sometimes complex evaluation process. You need to take into account the potential for wear and tear, depreciation over time, and external factors that could adversely affect the value of the asset. Engaging professionals for appraisals can be critical, ensuring you have an accurate understanding of the collateral’s worth, which will ultimately affect your borrowing capacity.

Plus, you must also consider the cost associated with maintaining the collateral. If your collateral is an asset like real estate, those ongoing expenses can eat into your financial capacity and should be factored into your overall loan strategy. Taking the time to understand these elements can save you from pitfalls down the line and equip you for more favorable loan terms.

Best Practices for Using Collateral in Secured Loans

Despite the inherent risks involved in borrowing, collateral can significantly enhance loan security when used thoughtfully. By implementing best practices, you can ensure that you not only secure the loan but also maintain financial stability. This includes conducting proper valuations, understanding loan terms and conditions, diversifying collateral, and regularly reviewing and updating your collateral valuations. By following these practices, you can maximize your collateral’s effectiveness while minimizing potential pitfalls.

Conducting Proper Valuations

Proper valuation of your collateral is critical in securing favorable loan terms. Ensure that you obtain accurate and objective assessments of your assets, whether they be real estate, vehicles, or other valuable items. Engaging a professional appraiser can provide you with reliable figures that reflect the true market value. This practice not only reassures lenders but also enables you to secure a loan amount that aligns with the market conditions.

When performing valuations, it’s necessary to consider market fluctuations that can affect the worth of your collateral. Periodic assessments are advised to keep your valuations accurate and up-to-date. This will ensure that you’re fully aware of how much equity you have in your collateral and can navigate your loan terms confidently.

Understanding Loan Terms and Conditions

Practices surrounding loan agreements can make the difference between a successful borrowing experience and financial distress. You should take the time to fully understand the terms and conditions laid out in your loan agreement, particularly those that pertain to collateral. Pay attention to the interest rates, repayment schedules, and any clauses associated with your collateral’s forfeiture. Being informed allows you to make better decisions about your financial commitments.

It’s crucial to clarify any ambiguous terms with your lender. For instance, if penalties are tied to missed payments, you should understand how they can affect your collateral. Engaging with your lender can also help ensure you are utilizing your collateral to its full potential without exposing yourself to unintended risks.

Diversifying Collateral to Spread Risk

Loan diversification is not only a strategy for your investment portfolio but also a vital element when it comes to using collateral effectively. By spreading your collateral among various asset classes—such as real estate, vehicles, or equipment—you reduce the risk of significant losses should one asset suffer a decline in value. This approach not only reassures your lender but also provides you with a safety net should you encounter financial difficulties.

Another advantage of diversifying your collateral is that it allows you to tailor your loan applications based on the value of your assets. Different lenders might have varied requirements for specific collateral types, thus increasing your borrowing potential in the bank of your choosing.

Regularly Reviewing and Updating Collateral Valuations

Terms can change in a dynamic market; therefore, it’s necessary to regularly review and update your collateral valuations. Frequent assessments help you stay informed about the current value of your assets, ensuring that you don’t overestimate or underestimate their worth. This practice is necessary for maintaining your financial health and ensuring that you have the required amount of collateral to support your loans effectively.

For instance, if you own property that has appreciated in value significantly, updating its valuation can potentially unlock new borrowing opportunities that were previously unavailable. This proactive approach not only protects your current investments but also positions you favorably for future financial endeavors.

Summing Up

Now that you understand the critical role collateral plays in securing long-term loans in the Rio Grande Valley (RGV), it is crucial to recognize how it can significantly protect your interests as a borrower. By offering collateral, you not only improve your chances of loan approval but also gain access to better terms, such as lower interest rates and extended repayment periods. This is particularly vital in a region like RGV, where local businesses and individuals may rely on financing for growth and sustainability. Not only does collateral provide reassurance to lenders, but it also fortifies your financial position, making it a strategic move in your borrowing decisions.

Ultimately, incorporating collateral into your loan application can create a win-win situation for both you and your lender. You increase your chances of obtaining necessary funds while minimizing risk for the lender, which can lead to a more efficient approval process. Thus, if you aspire to initiate on long-term financial commitments in the RGV, consider how appropriate collateral can bolster your eligibility and enable you to achieve your financial goals with confidence.

FAQ

Q: What is collateral and why is it important for securing long-term loans?

A: Collateral refers to an asset that a borrower offers to a lender as a guarantee for a loan. In the context of long-term loans, collateral is critical because it reduces the risk for lenders. If a borrower defaults on the loan, the lender has the right to seize the collateral to recover losses. This assurance often allows borrowers to access larger loan amounts or better interest rates compared to unsecured loans.

Q: What types of collateral are commonly accepted by lenders for long-term loans in the RGV?

A: Lenders in the RGV typically accept various forms of collateral, including real estate (homes, commercial properties), vehicles, equipment, and financial assets like savings accounts or stocks. The value of the collateral is assessed and must be equal to or greater than the loan amount to secure favorable lending terms.

Q: How does the value of collateral affect the loan amount and interest rates?

A: The value of the collateral directly influences the loan amount a borrower can secure. Lenders often base their loan-to-value (LTV) ratio on the assessed value of the collateral. A higher-value asset can lead to a larger loan amount and potentially lower interest rates because it represents a lower risk for the lender. Conversely, if the collateral is deemed less valuable, the lender may offer a smaller loan with higher interest rates as a precaution against the increased risk of default.

Q: What happens to the collateral if the borrower defaults on the loan?

A: If the borrower defaults on the loan, the lender has the legal right to seize the collateral to recover the outstanding loan balance. This process is known as foreclosure in the case of real estate or repossession for vehicles and other assets. Borrowers should clearly understand the implications of providing collateral and the potential loss of their assets should they fail to meet loan obligations.

Q: Are there alternatives to providing collateral for securing long-term loans?

A: Yes, while collateral can make it easier to secure long-term loans, there are alternatives such as unsecured loans, which do not require assets for backing. However, these loans typically come with higher interest rates and stricter eligibility criteria, as lenders assume a higher risk. Additionally, some borrowers may explore co-signing options, where a third party guarantees the loan, thereby providing some level of security to the lender.