Poor credit doesn’t have to be a barrier to obtaining a Merchant Cash Advance (MCA) in the Rio Grande Valley. In fact, many lenders understand the challenges businesses face and are willing to work with you to secure the funding you need, even if your credit score isn’t perfect. By exploring your options and understanding the requirements, you can increase your chances of loan approval. This post will guide you through the MCA process tailored for those with poor credit, helping you navigate the landscape of financial support available for your business.

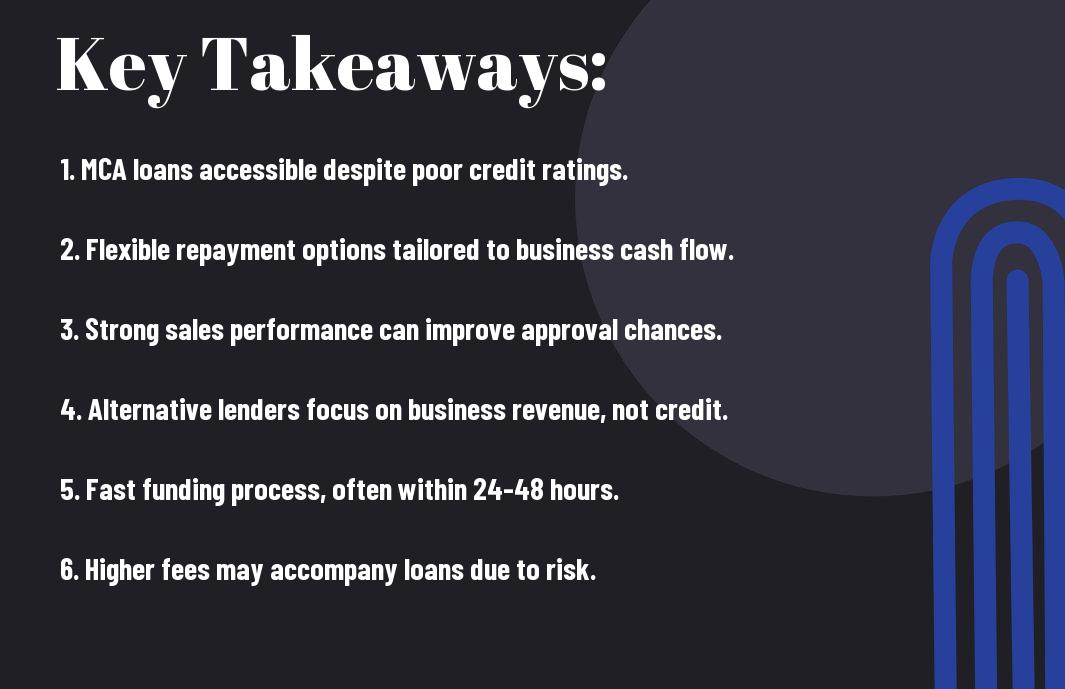

Key Takeaways:

- High Approval Rates: MCA loans often come with more lenient credit requirements, making it easier for businesses with poor credit to secure funding.

- Fast Funding: The application process for MCA loans is typically quicker than traditional loans, allowing businesses in the Rio Grande Valley to get access to cash rapidly.

- Flexible Repayment: MCA loans offer flexible repayment options, which can be especially beneficial for businesses with inconsistent cash flow.

Understanding MCA Loans

To fully grasp what Merchant Cash Advances (MCA) can offer, it’s important to investigate a deeper understanding of what they are and how they operate. The process can often seem daunting if you are unfamiliar with the terms and mechanics at play. However, with a clear comprehension of MCA loans, you can make better decisions that suit your financial needs.

Definition of Merchant Cash Advances

The term Merchant Cash Advance refers to a financing option that is based on your future credit card sales or receivables. Instead of receiving a traditional loan with fixed repayments, an MCA provides you with a lump sum of money that you will pay back through a percentage of your daily credit card or debit card sales. This arrangement can be particularly appealing if you’re a business owner in need of quick cash flow and lack the credit score needed for traditional bank loans.

With an MCA, you don’t have a set repayment term, which can provide flexibility during lean months. However, the trade-off is often a higher overall cost compared to conventional financing options. It’s crucial to evaluate whether an MCA aligns with your financial goals before proceeding.

How MCA Loans Work

Advances are issued based on your business’s daily credit card sales, which means the repayment is linked to your revenue. In this way, when business is thriving, you pay back more, and when sales are lower, your repayments decrease accordingly. This makes MCA loans particularly suited for businesses with seasonal fluctuations or those just starting out and looking to grow. You will typically receive your advance immediately after signing the agreement, giving you the capital needed without lengthy waiting periods.

Loans from an MCA provider are repaid through a daily or weekly deduction of a predetermined percentage from your credit card sales. This means that as your sales increase, the amount you pay back also rises. Conversely, during slower sales periods, the amount deducted will be less, providing you with a breathing space when cash flow is tight. Make sure to keep in mind the fee structure and total repayment amount, as these can significantly impact your business’s financial health.

Key Terminology Explained

Explained below are some of the crucial terms you should be familiar with when exploring Merchant Cash Advances. Understanding these terms will help you navigate the application process and make informed decisions. Key terms include “factor rate,” which determines the total cost of borrowing based on a multiplier applied to the amount you wish to borrow, and “holdback percentage,” which is the portion of your daily sales that will go towards repaying the advance.

Additionally, it’s important to know what “sellable accounts receivables” are, as they can serve as collateral for your MCA. Familiarizing yourself with these terms can help you understand the nuances of MCA loans and how they can benefit your business in the long run.

Cash flow is a vital concept in running your business. A good understanding of your cash flow situation empowers you to make smarter decisions regarding financing, including whether an MCA is the best fit for your specific circumstances. Taking the time to familiarize yourself with these terms will enable you to engage more effectively with potential MCA providers and ensure you choose the best funding option for your business.

The Impact of Poor Credit on MCA Loan Approval

Even for businesses in the Rio Grande Valley, having poor credit can significantly hinder your chances of obtaining a Merchant Cash Advance (MCA) loan. While MCAs are often seen as more accessible than traditional bank loans, lenders still evaluate your creditworthiness based on various factors. Understanding how your credit can impact your approval process is crucial if you are looking to secure funding for your business despite lacking a strong credit history.

Credit Score Fundamentals

Fundamentals of a credit score generally consist of five main components: payment history, credit utilization, length of credit history, types of credit, and new credit inquiries. Each of these elements contributes to your overall credit score, which can range from 300 to 850. A higher score typically indicates a lower risk to lenders, while a lower score can raise red flags. Even if you only have one of these components dragging down your score, it can greatly impact your chances of receiving an MCA loan.

Your credit score acts as a critical first impression for lenders, and a score below a certain threshold can lead to automatic disqualification for many financing options, including MCAs. In the competitive lending landscape, a poor credit score may not only diminish your odds of approval but can also lead to higher interest rates or less favorable terms should you be approved. Thus, it pays to be aware of the state of your credit score before you apply.

How Credit History Affects Lending Decisions

Approval of your MCA loan is significantly influenced by your credit history. Lenders want to see a reliable track record of timely payments and responsible credit usage, which signals financial stability. If your credit history reflects missed payments or excessive debt, lenders may view you as a riskier investment. This can lead to a higher likelihood of being denied or receiving unfavorable terms.

Affects of poor credit history can be particularly pronounced in industries perceived as higher-risk. For instance, if you operate in a sector known for economic volatility, lenders may scrutinize your credit history even more closely. The combination of your business sector and your credit history can create a challenging scenario when it comes to securing an MCA loan.

Lenders’ Perception of Risk

On top of your credit score and history, lenders assess their overall perception of risk related to your business. If you have poor credit, it paints a picture of potential financial instability that can deter lenders from investing in your business. They consider not just your credit score but also the broader economic context, and how your credit history plays into your ability to manage debt effectively.

Perception of risk can lead lenders to impose stricter criteria for approval. If a lender deems you high-risk due to your credit background, they may request additional documentation or collateral, charge higher fees, or completely deny your application. Understanding how lenders view risk can help you prepare better and potentially offset some of your disadvantages by demonstrating other positive attributes of your business, such as strong cash flow or a solid business plan.

Specific Challenges for Borrowers in Rio Grande Valley

Not every borrower in the Rio Grande Valley has an easy path to securing an MCA loan, particularly if you are dealing with poor credit. Addressing specific challenges requires an understanding of the unique local conditions that impact your ability to secure funding. For instance, economic factors significantly influence credit ratings, which directly affect your eligibility for loans. Understanding these challenges can empower you to navigate the lending landscape more effectively.

Economic Factors Influencing Credit Ratings

One of the primary economic factors influencing credit ratings in the Rio Grande Valley is the socioeconomic climate of the region. A high unemployment rate and lower median income levels can impact the overall creditworthiness of potential borrowers. Moreover, small business owners often rely heavily on seasonal revenue, which may lead to fluctuations in cash flow and result in less-than-ideal credit scores. Additionally, several local businesses experience cyclical sales patterns that may affect their financial stability throughout the year.

- High unemployment rates

- Lower median income levels

- Fluctuations in cash flow due to seasonal sales

- Cyclical sales patterns affecting business stability

The impact of these factors can create significant hurdles for you if you seek to obtain funding through an MCA loan. Understanding these elements will help you formulate a comprehensive approach to improving your financial situation.

Local Lending Practices and Trends

Any conversation about securing an MCA loan in the Rio Grande Valley must include an analysis of local lending practices and trends. The landscape for lending in this area often involves alternative financing methods that are not as established as traditional banks. Local lenders may have varying criteria for credit evaluations, which can affect your chances even more if you have poor credit. You may even find that lenders prioritize entrepreneurs with a strong community reputation or those who can demonstrate a steady income despite credit challenges.

The availability of alternative financing options, like Merchant Cash Advances, creates additional avenues for borrowers, but it often comes with higher interest rates and shorter repayment terms than traditional loans. This shift means you must navigate an array of non-traditional lenders, each with its own criteria and risk assessment models. Additionally, many lenders in the Rio Grande Valley may heavily emphasize local market dynamics, making it crucial for you to demonstrate local engagement and stability to increase your chances of approval.

Common Obstacles Faced by Small Businesses

Common obstacles faced by small businesses in the Rio Grande Valley include limited access to capital, fluctuating cash flow, and high operational costs. A significant part of this struggle arises from the competitive nature of the market and the prevalence of other small enterprises vying for the same resources. If you are in the process of applying for an MCA loan, encountering these hurdles can be frustrating. In addition, many small business owners face challenges related to inadequate financial planning, which may exacerbate their existing credit issues.

Trends indicate that local businesses are increasingly seeking to address these obstacles through strategic partnerships and collaborations. By leveraging community resources, networking, and local support systems, you can potentially create a more stable financial environment for your business. Engaging with local chambers of commerce or small business development organizations may provide you with valuable insights and resources to overcome common barriers, ultimately improving your prospects for securing loan approval, even with poor credit.

Improving Chances of Approval with Poor Credit

Unlike traditional lenders, who primarily focus on credit scores to determine eligibility for loans, many Merchant Cash Advance (MCA) lenders often take a more holistic approach to assessing your application. This means that even if you have a poor credit history, you still have the opportunity to secure funding by emphasizing alternative factors that showcase your business’s potential and stability. By understanding these alternative financial metrics, you can significantly improve your chances of approval despite your credit challenges.

Alternative Financial Metrics to Consider

One of the critical metrics to highlight is your revenue trends. MCA lenders are primarily concerned with your ability to repay the advance, and consistent revenue can speak volumes about your business’s financial health. Demonstrating steady growth in sales—regardless of your credit score—can provide lenders with the confidence that you will be able to meet repayment obligations. Additionally, factors such as business bank account balance and deposits may also be taken into consideration, allowing you to present a more comprehensive financial picture.

Strengthening Your Business Profile

With a focus on enhancing your business profile, there are several strategies you can implement to make your application more appealing. Start by ensuring that all your business documentation is up-to-date and well-organized. This includes your tax returns, financial statements, and any relevant business licenses. Presenting a strong business plan can also demonstrate your commitment and vision, which can resonate positively with lenders. Moreover, leveraging customer testimonials and case studies can add credibility to your operation, helping lenders feel more secure in your potential for success.

Your business profile is often the first impression lenders will have, so it’s vital to polish it effectively. If you have existing relationships with vendors who can vouch for your reliability or stability, reach out to them for a recommendation. Showing a long-standing relationship with suppliers or a solid customer base can reinforce your trustworthiness, which is especially important when your credit history isn’t pristine.

Importance of Cash Flow in Loan Applications

For MCA lenders, cash flow is often viewed as a vital indicator of your business’s health and its capacity to repay the cash advance. Unlike long-term loans that require a perfect credit score, MCAs focus more on your day-to-day revenue and the regularity with which you handle cash. Consequently, having a steady cash flow can significantly enhance your loan application, even if your credit is less than ideal. You should regularly analyze your revenue cycles and ensure you have ample operational cash on hand, which will not only support your application but also sustain your business functions during repayment.

Importance lies in understanding your cash flow management. By making it a priority to maintain positive cash flow, consistently tracking your income and expenses, you empower yourself to provide better insight into your financial status. This transparency creates trust and can often outweigh the concerns stemming from a poor credit history, allowing you to secure necessary funding when you need it most.

Options Beyond MCA Loans

For many entrepreneurs in the Rio Grande Valley, funding your business can feel like an uphill battle, especially when traditional MCA loans are off the table due to poor credit. However, there are various options you can explore that may offer the financial support you need without the pitfalls associated with high-interest MCA loans. By understanding these alternative financing options, you can make informed decisions that will help you secure the necessary funds for your business.

Traditional Loan Alternatives

Any business owner looking for financing should consider the range of traditional loan alternatives available. These can include loans from banks or credit unions that often come with lower interest rates. When exploring these options, it’s imperative to present a solid business plan and financial projections to improve your chances of approval, even if your credit history isn’t perfect.

Having a relationship with your local bank or credit union can also significantly impact your ability to secure a traditional loan. Engaging in open communication about your credit situation and demonstrating your commitment to your business can weigh favorably in their evaluation. Moreover, some institutions offer specialized loans for small businesses that take into account your current revenue and future potential rather than your credit score alone.

Business Lines of Credit

Traditional banks and credit unions also offer business lines of credit, which can serve as a flexible funding option for your operational needs. This type of financing allows you to draw from a credit limit as needed, only paying interest on the amount you actually use. A business line of credit can be particularly useful for managing cash flow fluctuations, seasonal expenses, or unexpected costs without the constraints of a lump-sum loan.

Loan terms for business lines of credit vary, so you may want to shop around to find a lender offering the best terms for your situation. These lines typically require some level of creditworthiness but can be easier to obtain than a traditional loan if you have a solid cash flow. By keeping your borrowing costs down and ensuring you know the terms and repayment expectations, you can effectively manage your funding needs while preserving your business’s financial health.

Peer-to-Peer Lending Platforms

To expand your funding options even further, you might consider peer-to-peer lending platforms. These platforms connect borrowers with individual lenders who are willing to fund your loan request. This method can provide a more personal touch, allowing you to present your story and business idea in a compelling way, which could resonate more with individual investors than a traditional bank lender.

Lending through peer-to-peer platforms often involves fewer stringent requirements compared to conventional financial institutions, making them a viable alternative if you’re grappling with poor credit. Rates can vary widely based on your perceived risk but may still offer a more favorable option than MCAs. By using these platforms, you can cultivate a network of potential investors who share an interest in supporting emerging businesses like yours, increasing your chances of securing the capital you need.

Selecting a Reputable Lender

Once again, the choice of lender can significantly impact your Merchant Cash Advance (MCA) loan experience, especially when you have poor credit. Given the unique challenges you face in securing financing, selecting a reputable lender is crucial. The right lender will not only provide you with the necessary funds but also guide you through the process and ensure you understand your obligations clearly.

Researching Lender Credentials and Reputation

To find a reputable lender, it’s crucial to thoroughly research their credentials and reputation within the industry. Start by looking for lenders that are members of recognized organizations and have a proven track record in providing MCAs. Online reviews and customer testimonials can offer valuable insight into the experiences of other borrowers, helping you gauge their reliability and customer service levels. Pay attention to any recurring issues or complaints to determine if a lender is worth your time.

Additionally, consider reaching out directly to the lender for any questions or concerns you may have regarding their services. A professional lender should willingly provide you with information on their loan process, criteria, and past borrower experiences. This is not only an opportunity for you to assess their credentials, but also a chance to see how they prioritize customer satisfaction.

Evaluating Loan Terms and Conditions

Credentials aside, it is equally important to closely evaluate the loan terms and conditions offered by potential lenders. Even with poor credit, you want to ensure that you are not being subjected to excessively high fees or unfavorable interest rates, which could make repayment overly burdensome. Examine the factors such as the repayment period, any upfront costs, and how the terms may adjust based on future defaults. Understanding these elements will help safeguard your financial interests as you navigate the MCA landscape.

Another key aspect to consider when evaluating loan terms is the flexibility they offer. Some lenders may allow for adjustments depending on your financial situation, which can provide peace of mind if you’re worried about meeting your obligations amidst fluctuating revenue streams.

Importance of Transparency and Customer Support

On your journey to securing an MCA loan, transparency and customer support should be major factors in your decision-making process. Lenders that clearly outline their processes, fees, and any potential pitfalls are more likely to be trustworthy. Make sure to ask questions about anything that seems unclear, and gauge the responsiveness of the lender’s support team. A reliable lender will prioritize clear communication and be readily available to assist you through your financing experience.

Lender transparency also indicates a commitment to ethical practices, which is vital, especially when dealing with poor credit circumstances. Knowing that you have access to solid support can relieve a lot of stress during the borrowing process and can significantly enhance your overall experience.

Conclusion

Now that you understand the intricacies of MCA loan approval in the Rio Grande Valley, especially when dealing with poor credit, it’s clear that there are viable options available for you. Although traditional lenders may turn you away, merchant cash advances provide a more flexible solution, allowing you to access the funds necessary to spur business growth or manage expenses. By focusing on your business’s cash flow rather than solely on your credit score, you can secure the financing you need to overcome financial hurdles and achieve your goals.

If your credit history poses challenges, it’s crucial to explore all available resources. You can consider options such as MCA Loans: An Option for Businesses with Bad Credit?. By leveraging merchant cash advances, you position yourself to regain stability and drive your business toward success, regardless of past credit challenges. Be mindful of, understanding your options is the first step toward making informed financial decisions that benefit your business in the long run.

FAQ

Q: What is an MCA loan?

A: A Merchant Cash Advance (MCA) is a type of financing that provides businesses with a lump sum of cash in exchange for a percentage of their future credit card sales or receivables. This financing option is often used by businesses that need quick funding for operational expenses or growth but may not qualify for traditional loans.

Q: Can I qualify for an MCA loan if I have poor credit?

A: Yes, one of the advantages of an MCA loan is that credit scores are not the primary factor in the approval process. Lenders typically look at a business’s revenue and cash flow rather than personal credit history. Consequently, even those with poor credit can secure financing through an MCA, provided they can demonstrate sufficient daily sales or revenue.

Q: What are the typical requirements for MCA loan approval in the Rio Grande Valley?

A: While specific requirements may vary by lender, common prerequisites for MCA loans include: operating a business for at least six months, generating a minimum monthly revenue (often around $10,000), having a registered business bank account, and providing documentation of daily credit card sales if applicable. Proof of identity and ownership may also be required.

Q: How quickly can I get approved for an MCA loan in the Rio Grande Valley?

A: MCA loans are known for their quick approval and fund disbursement process. Depending on the lender, applicants can receive approval within as little as 24 hours, with funds often available within a few days. This rapid turnaround makes MCA loans an attractive option for businesses in urgent need of cash.

Q: What factors do lenders consider when assessing my application for an MCA loan?

A: Lenders assess various factors to determine your eligibility for an MCA loan, including your business’s monthly revenue, the consistency of cash flow, credit card sales (if applicable), and overall business health. They may also consider the industry you operate in, as some industries are viewed as higher-risk than others.

Q: Are there any risks associated with MCA loans for those with poor credit?

A: Yes, while MCA loans can be a viable option for those with poor credit, they come with higher costs and risks. The repayment structure, which typically involves a percentage of daily credit card sales, can strain cash flow. Additionally, MCA loans often carry higher interest rates compared to traditional loans, making it vital to evaluate if the loan terms are sustainable for your business.

Q: How can I improve my chances of getting approved for an MCA loan in the Rio Grande Valley?

A: To enhance your likelihood of securing an MCA loan, focus on maintaining steady revenue and cash flow, ensuring your business’s financial documents reflect stability. Establishing a good relationship with a lender, being transparent about your business needs, and having a clear repayment strategy can also positively influence the approval process.