It’s crucial for you to understand the various student loan repayment strategies available as a graduate from the Rio Grande Valley. Navigating your loan repayment options can significantly impact your financial future, so being informed about your choices is imperative. Whether you’re interested in income-driven repayment plans or loan forgiveness programs, this guide will equip you with the necessary knowledge to manage your debt effectively. For additional tips, check out The Top 10 Student Loan Tips for Recent Graduates.

Understanding Student Loans

While navigating the world of student loans can feel overwhelming, it’s necessary to understand the basics to make informed decisions about your financial future. This knowledge will empower you as you transition from student life into the workforce, helping you effectively manage your repayment obligations. Ensuring you grasp the types of loans available, their respective interest rates, and the various repayment plans can lead to a smoother repayment journey.

Types of Student Loans

Loans come in various forms, and identifying which type you have is crucial in determining your repayment strategy. Here’s a breakdown of the main types of student loans:

| Loan Type | Description |

| Federal Direct Loans | These loans are issued by the federal government and often have lower interest rates. |

| Federal Perkins Loans | These loans are for students with exceptional financial need; they have a fixed interest rate. |

| PLUS Loans | Parent or graduate student loans that cover the cost of attendance minus other financial aid. |

| Private Student Loans | Loans offered by private lenders, which often have varying interest rates and repayment terms. |

| State Loans | Loans offered by state governments, usually with benefits for residents of the state. |

- Federal Direct Loans: Available to undergraduate and graduate students.

- Federal Perkins Loans: Subsidized loans for students demonstrating exceptional need.

- PLUS Loans: Available for parents and graduate students with good credit.

- Private Student Loans: Offered by banks and credit unions, usually requiring good credit for approval.

- State Loans: Tailored for residents and may come with special benefits.

Recognizing the type of loan you have is imperative because it will determine your repayment timeline and options available to you.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment plans associated with your student loans is vital for effective financial planning. Interest rates can significantly influence your total repayment amount, so knowing whether your loans are fixed or variable is necessary. Fixed rates remain the same throughout the life of the loan, while variable rates can fluctuate based on economic conditions. Familiarizing yourself with your loans’ interest rates helps you budget appropriately and avoid long-term financial strain.

The repayment plans available to you can also vary based on the type of loan you have. Federal loans typically offer several repayment options, including Standard, Graduated, and Income-Driven Repayment plans. Income-Driven Repayment plans can be particularly beneficial for recent graduates who may find themselves on a tighter budget. They adjust your monthly payments based on your income and family size, ensuring that your payments remain manageable as you gain financial stability.

Federal vs. Private Student Loans

The distinction between federal and private student loans is important for crafting your repayment strategy. Federal loans generally offer more borrower protections, such as deferment, forbearance options, and access to forgiveness programs. These loans typically have fixed interest rates, which can simplify budgeting. On the other hand, private loans may come with variable interest rates and various repayment terms, often requiring a credit check for eligibility. This can complicate your financial planning if you encounter changes in your income or financial situation.

Plus, understanding the long-term implications of your loans can guide you in making better choices about how to prioritize repayment. If you have both federal and private loans, it’s crucial to develop a strategy that addresses the differences in interest rates and repayment options, ensuring you manage your debt efficiently.

The Financial Landscape of the Rio Grande Valley

Little do many graduates know, the financial landscape they step into post-college is complex and multi-faceted. In the Rio Grande Valley (RGV), it is crucial to understand local economic conditions, average student debt, and cost of living to effectively plan your student loan repayment strategy. With the right knowledge and tools, you can navigate these factors to create a sustainable financial future.

Average Student Debt in the Region

Valley graduates typically face a student debt burden that mirrors national trends, but with unique local nuances. The average student loan debt in the RGV has surged over the past decade, reflecting rising tuition costs and an increasing number of students pursuing higher education. As you enter the job market, awareness of your debt level can inform your approach to repayment, allowing you to set realistic financial goals.

In light of the economic challenges in the region, it’s vital for you to keep an eye on the average student debt. As reported, graduates in the RGV often leave colleges with debt that significantly impacts their financial stability and decisions. This can serve as a wake-up call for your planning and budgeting, ensuring that your future financial strategies encompass debt repayment as a priority.

Job Market Trends for Graduates

With the steady growth of various industries in the RGV, job market trends for graduates are becoming increasingly positive. The region has witnessed a rise in jobs linked to healthcare, technology, and education. This shift not only opens doors for you as a new graduate, but it also often translates to better salary prospects, which can be crucial when considering your student loans.

Student attendance at colleges and universities in the RGV has led to a competitive job market, with certain sectors experiencing a notable increase in demand. As you identify potential career paths, being aware of these trends can empower you to make informed choices about job applications and salary negotiations, thus paving the way for timely student loan repayments.

Cost of Living Comparisons

Living in the RGV offers several advantages in terms of cost when compared to larger cities in Texas and the nation as a whole. Understanding living expenses can give you a clearer picture of how to allocate your finances, particularly when you have student loans to consider. Below is a comparison of some key cost categories.

Cost of Living Breakdown

| Category | Average Cost (RGV) |

|---|---|

| Rent (1-bedroom apartment) | $800 |

| Utilities | $150 |

| Groceries | $300 |

| Transportation | $100 |

Plus, when you assess these costs against expected salaries in your chosen field, you can make informed decisions around your budgeting and lifestyle choices. The relatively low cost of living in the RGV provides additional financial breathing room for you as you begin on your loan repayment journey. By understanding these dynamics, you can effectively balance your debt obligations with your living expenses.

Repayment Options Available to Graduates

For Rio Grande Valley graduates, understanding the various student loan repayment options is vital for managing your financial future effectively. As you initiate on your career, having a clear repayment strategy can help you balance your new responsibilities with your financial obligations. Generally, these options range from standard plans to income-driven strategies that consider your earnings and family size, thus aligning your repayments with your capability to pay.

Standard Repayment Plan

For those who prefer a straightforward approach, the Standard Repayment Plan is a viable option. Under this plan, you will make fixed monthly payments over a period of ten years. This predictability can assist you in budgeting your expenses as you enter the job market. Additionally, this plan typically results in you paying less interest over time compared to other options, making it financially advantageous in the long run.

For graduates who have a stable income and prefer to pay off their debts quickly, this plan might be the most appealing. It allows you to tackle your loans head-on and become debt-free relatively quickly. However, if your financial situation does not allow for higher monthly payments, you might want to explore other repayment strategies that provide more flexibility.

Graduated Repayment Plan

Any recent graduate may find the Graduated Repayment Plan appealing, particularly if you expect your salary to increase significantly in the early years of your career. This plan starts with lower monthly payments that gradually increase over time—typically every two years—over a 10-year period. It can be an excellent choice for new graduates who are entering fields with high earning potential.

To take full advantage of this plan, consider your projected salary trajectory and whether you are comfortable with gradually increasing payments. It’s best to ensure that your anticipated income growth can accommodate these rising payments without causing financial strain. Many professionals find that this approach offers an easier entry into repayment while allowing for future growth as their earnings rise.

Income-Driven Repayment Plans

Graduated plans aren’t the only option for flexible repayment; income-driven repayment plans are worth exploring as well. These plans adjust your monthly payment based on your income and family size, making them particularly beneficial if you’re entering the workforce with a lower salary or uncertain income. By capping your payments at a certain percentage of your discretionary income, you can ensure that your repayment plan aligns more closely with your financial realities.

Standard income-driven repayment options can be an optimal choice for individuals who may not have a consistent or high income initially. As your financial circumstances change, these plans will adapt to ensure your payments remain manageable without sacrificing your ability to afford other living expenses.

Loan Forgiveness Programs

Income-driven repayment plans also open the door to potential loan forgiveness opportunities. If you work in the public service sector or qualify for specific forgiveness programs, you may be eligible to have your remaining student loan balance forgiven after making a certain number of qualifying payments. This could significantly reduce your overall debt burden and give you financial relief as you progress in your career.

A thorough understanding of the requirements associated with forgiveness programs is critical, as they often involve strict eligibility criteria such as employment in qualifying sectors or consistent participation in income-driven repayment plans. Explore these options carefully to maximize the benefits available to you as a Rio Grande Valley graduate.

Strategies for Effective Repayment

Now, if you’re a graduate from the Rio Grande Valley facing the challenge of student loan repayment, establishing a solid plan can make a significant difference. Implementing effective repayment strategies can help you manage your debt more efficiently, ultimately saving you money and reducing stress. This chapter explores various strategies tailored to enhance your student loan repayment experience.

Creating a Budget

Any successful repayment strategy begins with a well-structured budget. You should start by tracking your income and expenses to determine how much you can allocate towards your student loans each month. Break down your expenditures into necessary categories such as housing, food, transportation, and student loan payments. By prioritizing your loan payments in your budget, you’ll gain a clearer understanding of your financial situation and how to manage it effectively.

Once you’ve identified your expenses, consider reducing discretionary spending. This might involve cutting back on dining out, subscription services, or any other non-necessary costs. You may also explore side gigs or part-time work to generate extra income that can be directed toward your student loans, allowing you to make your repayments more manageable and efficient.

The Snowball vs. Avalanche Methods

Methods of repayment can have a drastic effect on your financial health, especially during an extended repayment period. The snowball method focuses on tackling your smallest loan balances first to build momentum and motivation, while the avalanche method targets higher-interest loans, potentially saving you the most money over time. Understanding these two distinct approaches will help you decide which strategy aligns best with your financial habits and goals.

Understanding the nuances of these methods can empower you to make an informed decision. If you find that psychological satisfaction drives you, the snowball method may keep you motivated as you pay off smaller debts. Conversely, if you prefer a more analytical approach that maximizes savings, the avalanche method could be the right fit for you, minimizing your overall interest payments.

Refinancing Options

Strategies for refinancing your student loans can help you secure a lower interest rate or adjust the terms of your repayment, which can translate into lower monthly payments or reduced overall debt. Investigating different lenders and loan servicers allows you to compare offers, ensuring you select the option that best suits your financial situation. Additionally, refinancing can also consolidate multiple loans into one, simplifying your payment process.

To consider refinancing, assess your current financial circumstances. If you’ve improved your credit score since obtaining your loans or if market interest rates have decreased, you may qualify for better terms. However, weigh the benefits against potential downsides, such as losing access to federal loan protections or forgiveness programs that are unavailable for refinanced loans.

Making Extra Payments

On your journey to successfully managing student loan repayments, making extra payments can significantly reduce both the amount of interest paid and the length of your loan term. If your financial situation allows for it, consider dedicating any windfalls, such as tax refunds, bonuses, or gifts, toward your student loan principal. Regularly making extra payments can lead to substantial savings over the life of your loans.

This proactive approach ensures you’re not just meeting the minimum payments but actively diminishing your overall debt. Remember to check with your loan servicer to ensure that additional payments are applied directly to the principal and not just future interest. This small step can pave the way for a quicker debt payoff and provide considerable peace of mind as you work towards financial freedom.

Resources for Graduates in the Rio Grande Valley

Not all resources are widely known, and as a graduate in the Rio Grande Valley, it’s crucial to tap into available support systems. Various organizations provide tailored services to help you navigate the complexities of student loan repayment, ensuring you make informed decisions about your financial future. From financial counseling to local workshops and online tools, knowing where to find these resources can empower you to take control of your student loans.

Financial Counseling Services

An crucial resource for Rio Grande Valley graduates is financial counseling services. These organizations offer personalized guidance on managing student loan repayment, budgeting, and developing a sustainable financial plan. Engaging with a financial counselor can provide you with the clarity and confidence needed to tackle your debts strategically. Many local nonprofits and educational institutions offer free or low-cost counseling sessions to help you understand your options.

Furthermore, seasoned financial counselors can help you assess your unique situation, including income, debt levels, and financial goals. By working closely with a counselor, you can evaluate various repayment plans, consolidate your loans, or even explore forgiveness programs that may be available based on your career path or income level. Make sure to take advantage of these resources, which can ultimately lead to a more secure financial future.

Local Workshops and Seminars

With a growing number of local organizations focusing on financial literacy, you have access to workshops and seminars designed to educate recent graduates. These events often cover topics such as student loan repayment strategies, budgeting techniques, and financial planning. Participating in these sessions not only equips you with crucial knowledge but also connects you with like-minded individuals facing similar challenges.

For instance, community colleges and universities in the Rio Grande Valley frequently organize financial workshops aimed specifically at recent graduates. These sessions may feature guest speakers, including financial experts and loan servicers, who can provide firsthand insights into managing your loans effectively. Engaging in such community-driven initiatives can help you stay informed about emerging trends and resources in the financial landscape.

Online Tools and Calculators

Online resources are invaluable for graduates seeking to manage their student loans efficiently. A variety of websites offer loan repayment calculators, budgeting tools, and in-depth articles about different repayment options. Utilizing these online tools can help you evaluate your current financial situation, project future payments, and decide the best course of action for your loans.

This technological approach equips you with vital information at your fingertips. Whether you need to estimate monthly payments based on your income or compare different repayment strategies, these online calculators can simplify complex decisions. Additionally, many platforms provide useful tips and best practices for navigating student loans, making it easier for you to create a customized repayment plan that aligns with your financial goals.

Common Pitfalls to Avoid

Despite the growing understanding of student debt, many graduates in the Rio Grande Valley still make crucial mistakes during the repayment process. These common pitfalls can lead to unnecessary financial stress and prolonged debt burdens. It’s necessary to be aware of these issues so you can navigate your student loan repayment with confidence.

Ignoring Loan Servicer Communication

Common among recent graduates is the tendency to overlook communications from their loan servicer. Whether it’s important updates about your repayment terms or notices regarding changes in interest rates, failing to stay informed can cost you. Keeping an open line of communication with your servicer allows you to stay on top of your repayment plan and address any questions or concerns before they become significant problems.

Furthermore, your loan servicer may provide you with options for repayment plans or forgiveness programs specific to your financial situation. Ignoring these communications can lead you to miss out on opportunities to lower your monthly payments or potentially eliminate your debt sooner. In an era where student loans loom large, it’s vital to engage actively with your servicer to understand your options fully.

Falling for Scams

Ignoring the possibility of scams targeting student loan borrowers is another pitfall that can be detrimental to your financial health. Fraudsters often prey on graduates by offering unrealistic promises, such as immediate loan forgiveness or significantly lower payment plans for a fee. It’s crucial to remember that legitimate loan forgiveness programs are offered only through government channels and that most repayment plans can be arranged directly with your loan servicer without any upfront costs.

Scammers often use high-pressure tactics to get you to act quickly, but it’s important to take a step back and assess the situation. Always verify any company or individual claiming to provide student loan assistance and feel free to report suspicious activity to authorities. Your financial well-being deserves your vigilance.

Underestimating Loan Balances

Avoid the common error of underestimating your loan balances when planning your finances. Many graduates have a tendency to focus only on their monthly payments without considering how this relates to the total amount owed. Understanding your full loan balance is crucial to creating a feasible repayment strategy. Failing to recognize the true extent of your debt can lead to financial mismanagement and unexpected challenges.

The best way to stay informed is to regularly review your loan statements and account details. This practice will help you stay aware of how your payments are affecting your loan principal and interest. Understanding the numbers involved will allow you to budget effectively and make informed decisions, ultimately putting you in a better position to tackle and pay off your debt more successfully.

To wrap up

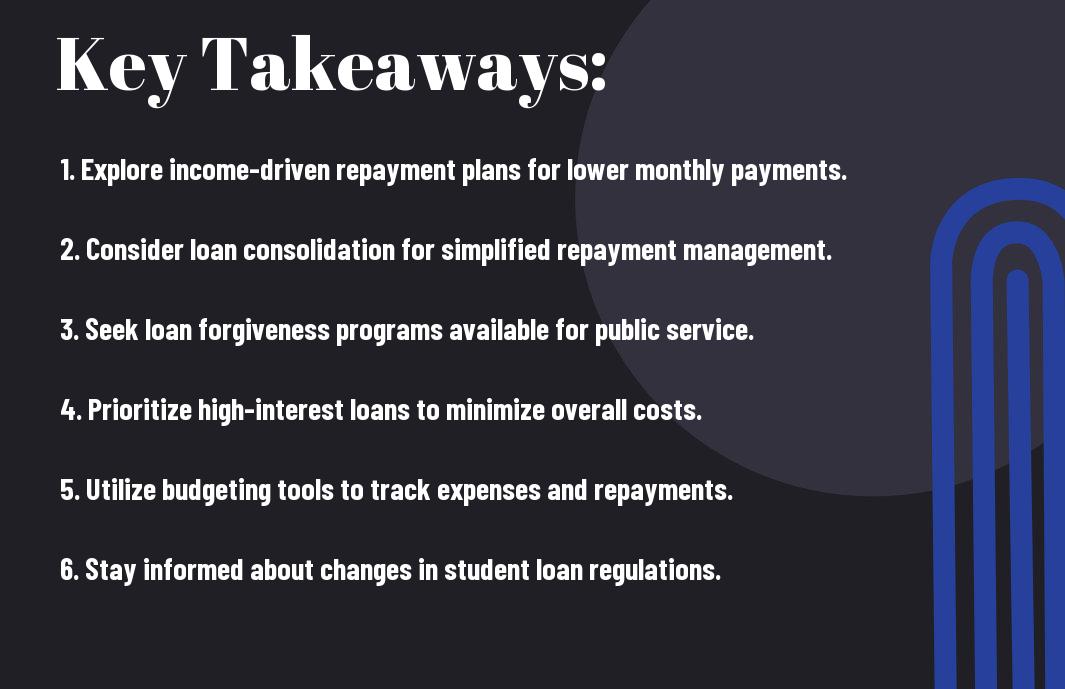

Taking this into account, it is imperative for Rio Grande Valley graduates to develop a comprehensive strategy for repaying their student loans. By understanding the various repayment options available—such as income-driven repayment plans, loan consolidation, or refinancing—you can tailor your approach to fit your financial situation and long-term goals. Remember to regularly reassess your financial standing and be proactive in adapting your repayment plan as needed. Utilize resources such as financial aid offices or loan servicers to stay informed about any changes in your loans or new financial assistance programs that may arise.

Additionally, you should consider exploring loan forgiveness programs, particularly those that target educators or public service employees in the Rio Grande Valley. Staying engaged with local community initiatives and employment opportunities can not only amplify your career prospects but also potentially reduce the burden of your student loans. Ultimately, by actively managing your repayment strategy and seeking out resources, you can take control of your financial future and work towards eliminating your student loan debt successfully.

FAQ

Q: What are the best student loan repayment strategies for graduates from the Rio Grande Valley?

A: The best student loan repayment strategies for Rio Grande Valley graduates include income-driven repayment plans, refinancing options, and the Public Service Loan Forgiveness (PSLF) program. Graduates should assess their financial situation and consider options that minimize monthly payments while potentially maximizing forgiveness. Consolidating loans may also reduce the interest rate or the monthly burden, depending on circumstances.

Q: Are there any specific loan forgiveness programs for graduates in the Rio Grande Valley?

A: Yes, graduates from the Rio Grande Valley may qualify for loan forgiveness programs like the Public Service Loan Forgiveness (PSLF) for those working in nonprofit, government, or education sectors. Additionally, some state-specific programs might offer incentives for graduates who choose to work in high-need areas such as healthcare or education within the region.

Q: How can I determine which repayment plan is best for my student loans?

A: To determine the best repayment plan for your student loans, consider factors such as your income, job stability, and financial goals. Use the Department of Education’s loan simulator tool to compare different options, including Standard, Graduated, Extended, and Income-Driven Repayment plans. It may also be beneficial to seek the advice of a financial advisor or a student loan counselor specialized in education financing.

Q: What resources are available for Rio Grande Valley graduates struggling with student loan debt?

A: Graduates struggling with student loan debt have access to several resources, including local financial aid offices, nonprofit credit counseling services, and state or federal loan servicer programs. Additionally, organizations like the Texas Guarantee Student Loan Corporation can provide advice on managing student loans, as well as tips for repayment plans and options for forgiveness.

Q: What should I do if I am unable to make my student loan payments on time?

A: If you are unable to make your student loan payments on time, it is crucial to contact your loan servicer as soon as possible. Many servicers offer options such as deferment, forbearance, or altering your repayment plan to help ease the financial burden. Additionally, utilizing an income-driven repayment plan may lower your payments based on your earnings. Be proactive in seeking assistance to avoid defaulting on your loans.