Did you know that nearly 60% of borrowers in the Rio Grande Valley are opting for alternative lenders this month? This shift highlights a growing preference for personalized service and flexible repayment options that traditional banks often overlook. With top loan lenders like Valley Funding Group and Rio Grande Capital making waves, you might be curious about what sets them apart. Understanding their unique offerings could be key to making an informed decision that aligns with your financial goals.

Key Takeaways

- Valley Funding Group and Rio Grande Capital are among the top private money lenders in the Rio Grande Valley this month.

- Lone Star Lending and South Texas Loans also offer competitive personal loan options with quick approval times.

- Interest rates for personal loans in the area range from 6.99% to 18.00%, varying by lender.

- Average approval times for loans from these lenders are typically between 24 to 72 hours.

Overview of Loan Options

In Rio Grande Valley, personal loans frequently provide flexible repayment options that can easily align with your budget needs. These loans, such as those offered by Atlas Credit, include signature, starter, and installment loans, catering to a wide range of financial situations. This flexibility guarantees you can find a loan that fits comfortably within your financial landscape.

One of the key advantages of personal loans in this region is that approval isn't solely determined by your credit score. This accessibility makes it possible for individuals with bad credit or low income to secure the financial help they need. If you're facing challenges like catching up on bills or managing unexpected expenses, personal loans can be an essential resource.

Moreover, timely payments on these loans can greatly improve your credit score over time. By demonstrating responsible borrowing behavior, you're not just addressing immediate financial needs; you're also enhancing your creditworthiness for future opportunities. Whether you're looking to consolidate debt or fund a personal project, understanding the array of loan options available can empower you to take control of your financial journey.

Criteria for Choosing Lenders

When selecting a lender, it's essential to compare interest rates to make sure you're getting the best deal possible. Also, consider the flexibility of loan terms, as this can greatly impact your repayment options. Finally, assess the speed of the approval process, since a faster turnaround can be vital in urgent financial situations.

Interest Rates Comparison

Analyzing interest rates from various loan lenders in the Rio Grande Valley is vital for securing the most favorable borrowing terms tailored to your financial situation. Start by comparing interest rates from the top lenders in the region to identify competitive offers. It's important to take into account average interest rates for loans in the area, as this knowledge will help you make informed decisions when selecting a lender.

In your search, don't just focus on rates—examine the loan terms and conditions provided by different lenders to make sure they align with your financial goals. Take the time to evaluate the reputation and customer reviews of these lenders; a solid track record of reliability and customer satisfaction can greatly impact your overall experience.

Utilizing online resources and tools to compare interest rates can also streamline your process, making it easier to visualize and understand your options. Remember, finding the right lender isn't just about getting the lowest interest rate; it's about choosing a partner who understands your needs and can support your financial journey. So, take your time, research thoroughly, and make a choice that feels suitable for you.

Loan Terms Flexibility

Choosing a lender with flexible loan terms can greatly enhance your borrowing experience by aligning repayment options with your financial needs. When you explore lenders in the Rio Grande Valley, look for those that offer a variety of loan options, such as personal loans, installment loans, and signature loans. This diversity enables you to select a loan type that best suits your situation.

One of the key advantages of flexible loan terms is the ability to choose repayment schedules and amounts that align with your financial goals. This adaptability not only helps you manage your budget effectively but also mitigates the stress associated with fixed repayment structures. Additionally, top lenders prioritize customer satisfaction, providing clear and transparent terms that help you understand the interest rates and repayment implications.

As you search for the right lender, consider how their flexibility can directly impact your financial journey. By securing a loan that fits your unique needs, you'll foster a sense of belonging to a financial community that values your individuality. Ultimately, a lender that prioritizes flexibility can make all the difference in achieving your financial aspirations.

Approval Process Speed

A quick approval process can greatly impact your experience with lenders, allowing you to access funds promptly when you need them most. When considering a lender in the Rio Grande Valley, you should prioritize those that offer quick loan approval, as this can significantly ease your financial stress. Atlas Credit stands out in this regard, often providing same-day approvals, ensuring you're not left waiting in uncertainty.

What's also appealing about Atlas Credit is their approach to evaluating loan applications. They consider a range of factors beyond just credit scores, making their services more accessible to individuals from various financial backgrounds. This means that even if you have a less-than-perfect credit history, you still have a chance to secure the funds you need.

Moreover, the clarity of terms and conditions offered by Atlas Credit guarantees you fully understand your obligations, which can alleviate anxiety about hidden fees or complicated repayment structures. Their flexible repayment options allow you to customize your loan to better fit your budget. When you're in a financial bind, having a lender that prioritizes speed and transparency can make all the difference.

Top Private Money Lenders

When considering investment opportunities in the Rio Grande Valley, top private money lenders can provide the quick financing you need to capitalize on lucrative real estate deals. Unlike traditional banks, these lenders offer faster approval processes and flexible terms tailored for real estate investors. This means you can act quickly and effectively seize the moment without lengthy delays.

Here's a look at some of the top private money lenders in the region:

| Lender Name | Loan Types Offered | Average Approval Time |

|---|---|---|

| Valley Funding Group | Fix & Flip, Bridge Loans | 24-48 hours |

| Rio Grande Capital | Residential, Commercial | 48-72 hours |

| Lone Star Lending | Investment Properties | 24-48 hours |

| South Texas Loans | Short-term, Long-term | 48-72 hours |

Loan Application Process

Understanding the loan application process is vital to effectively securing financing from private money lenders in the Rio Grande Valley. The process typically starts with filling out an online form that requires your personal and financial information. It's pivotal to be thorough and accurate while providing these details, as they form the basis for your application.

You'll likely need to submit various documents for verification, such as your ID, proof of income, and bank statements. Having these ready can expedite the process significantly. Many top lenders in the area pride themselves on a swift approval system, with some offering same-day approvals for qualified applicants.

Be prepared for a credit check, which evaluates your creditworthiness. This step is crucial for lenders to determine the risk involved in lending to you. Once your application is approved, you can expect clear communication regarding the loan terms, including interest rates, fees, and repayment options. By understanding these elements of the loan application process, you can make informed decisions and feel more confident in your financing journey.

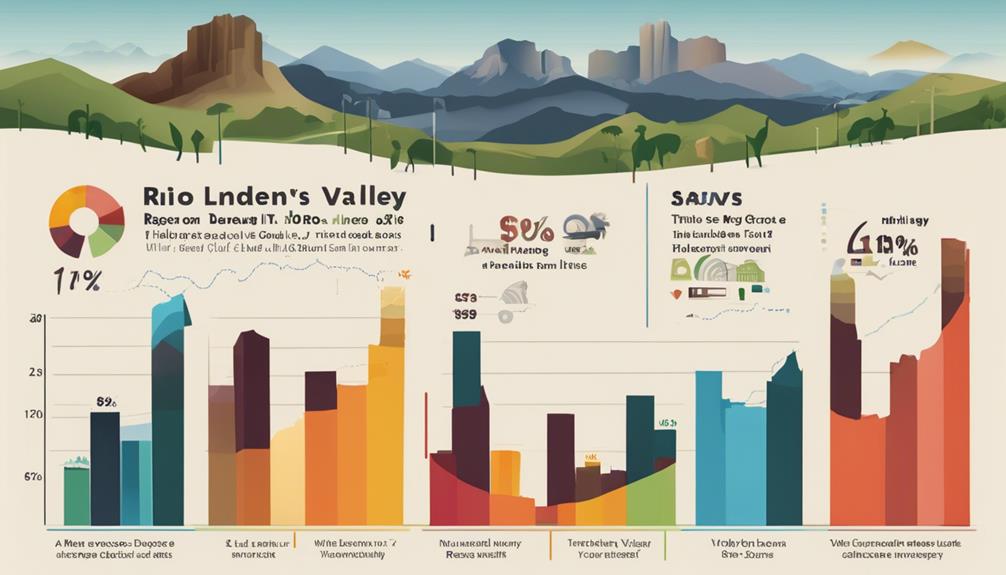

Interest Rates Comparison

When comparing interest rates in the Rio Grande Valley, you'll notice significant variations among lenders. Private money loans average around 10.5%, while personal loan rates can range from 6.99% to 18.00%. Understanding these trends will help you make informed decisions about the best loan options available.

Current Rate Trends

Private money interest rates in the Rio Grande Valley typically hover between 10-12%, reflecting a competitive landscape for borrowers seeking funding. If you're considering a loan, this rate range is important to understand, as it can greatly impact your overall costs. With private lenders often specializing in real estate investment loans, from fix-and-flip projects to rental properties, the interest rate you secure can influence your project's profitability.

Loan amounts from these lenders generally range from $50,000 to $1 million, providing flexibility based on your needs. Additionally, private lenders may offer loan-to-value (LTV) ratios of up to 70%, which can be advantageous if you're looking to leverage your investment. Keep in mind that origination fees for these loans typically hover around 2-4%.

As you evaluate your options, it's vital to compare the interest rates and terms offered by different lenders. Understanding the current rate trends will empower you to make informed decisions, ensuring you find a loan that aligns with your financial goals and aspirations in the vibrant Rio Grande Valley.

Lender Rate Variations

Interest rates for loans in the Rio Grande Valley can differ greatly among lenders, making it important for borrowers to compare options to secure the best possible deal. Some lenders may offer lower interest rates, which can greatly impact your overall loan costs. By taking the time to shop around, you can potentially save a substantial amount of money.

When comparing interest rates, it's essential to understand that several factors influence what lenders offer. Your credit score, the loan amount, and the loan term all play a role in determining the interest rates available to you. If you have a strong credit score, you're more likely to qualify for lower rates, which can make a significant difference.

To make informed decisions, gather rate quotes from multiple lenders. This not only helps you find the most competitive interest rates, but it also enables you to choose a loan option that aligns with your financial situation. Remember, the right loan isn't just about getting approved; it's about securing terms that support your long-term financial goals. By understanding lender rate variations, you're empowering yourself in the loan process.

Benefits of Local Lenders

Choosing local lenders in the Rio Grande Valley can offer important advantages, including personalized service and a deeper understanding of the community's financial landscape. When you work with local lenders, you're engaging with professionals who know the area well, which often translates to faster loan approval processes. Their familiarity with local market dynamics means they can assess your application more efficiently.

Additionally, local lenders may provide more flexible lending criteria. If you find yourself in a unique financial situation, these lenders are typically more willing to collaborate and find solutions that suit your needs. This flexibility can be essential for many borrowers looking for tailored financial options.

How to Improve Credit Score

Improving your credit score involves several key strategies. You should focus on making timely payments, keeping your debt utilization low, and diversifying your credit types. By implementing these practices, you can enhance your creditworthiness and better position yourself for favorable loan options.

Timely Payments Matter

Making timely payments on your loans is vital for enhancing your credit score and demonstrating financial responsibility. By consistently paying on time, you show lenders that you can manage your obligations effectively, which can positively influence your credit rating. Each on-time payment contributes to a solid repayment history, a key factor in rebuilding and improving your credit score over time.

When you prioritize timely payments, you not only reflect financial reliability on your credit report but also increase your chances of being approved for future loans. Lenders view a history of responsible repayment as a strong indicator of creditworthiness. This can lead to better loan terms and lower interest rates, helping you achieve your financial goals.

It's important to stay organized with your payment schedules. Setting reminders or automating payments can help guarantee you never miss a due date. Remember, every timely payment reinforces your commitment to financial responsibility, enhancing your credit score and fostering a sense of belonging in the financial community. By focusing on timely payments, you set yourself up for long-term success in your financial journey.

Reduce Debt Utilization

Reducing your debt usage ratio is crucial for boosting your credit score and showcases your ability to manage credit responsibly. A lower ratio not only reflects your creditworthiness but also makes you more appealing to lenders when you apply for loans.

To effectively lower your debt usage, consider the following strategies:

- Pay down existing debt: Focus on reducing your outstanding balances, especially on credit cards, which can greatly impact your ratio.

- Avoid maxing out credit cards: Aim to keep your balances well below your credit limits to maintain a healthy usage rate.

It's ideal to keep your debt usage below 30%. This shows lenders that you're not overly reliant on credit, which can lead to better loan terms and approval rates. Additionally, making timely payments and practicing responsible credit management can further enhance your credit profile. By prioritizing these strategies, you can work towards a stronger financial future and enjoy the benefits of improved credit.

Diversify Credit Types

To further enhance your credit score, consider diversifying your credit types, as a varied mix demonstrates your ability to manage different forms of credit responsibly. Financial institutions look favorably on individuals who have a combination of credit accounts, including credit cards, installment loans, and mortgages. This mix not only shows your financial responsibility but also highlights your creditworthiness.

Having a diverse credit profile can notably improve your credit score, as it indicates your capability to handle various types of debt. Lenders appreciate seeing a balanced history, which can ultimately lead to better interest rates and loan options in the future.

Real Estate Investment Loans

Real estate investment loans from private money lenders in the Rio Grande Valley provide investors with quick access to capital for property acquisitions and renovations. If you're looking to make a move in the dynamic real estate market, these loans can be an essential resource. While they may come with higher interest rates, the benefits often outweigh the costs, especially when speed is essential.

Here are a few key advantages of using private money loans in Texas:

- Fast Approval: You can secure funding quickly, allowing you to act on lucrative opportunities without delay.

- Flexible Terms: Many private lenders cater to your specific needs, making it easier to negotiate terms that work for you.

Customer Reviews and Experiences

How have customers in the Rio Grande Valley experienced loan processes with local lenders this month? The feedback has been overwhelmingly positive. Many customers have praised the top loan lenders for their excellent customer service and efficient processes. You'll find that quick access to funds is a recurring theme in reviews, which is pivotal for those needing immediate financial assistance.

The hassle-free loan application process has also been highlighted, making it easier for borrowers to navigate their options. Transparency and professionalism are key factors that customers appreciate, fostering a sense of trust and belonging within the community. People feel valued and respected, which enhances their overall experience.

If you're considering a loan, knowing that local lenders are committed to providing a supportive and efficient service can be reassuring. This month, the positive reviews reflect a strong commitment to customer satisfaction, and it's clear that many feel they're in good hands. If you want to learn more about your options and how these lenders can meet your needs, don't hesitate to reach out. Contact us today to explore your possibilities with trusted local lenders.

Resources for Borrowers

Local lenders in the Rio Grande Valley not only provide exceptional customer service but also offer a range of resources that can assist borrowers in making informed financial decisions. Understanding your loan options and managing monthly payments effectively is essential for your financial health. Here are some valuable resources you can tap into:

- Loan Calculators: Many lenders provide online tools to help you estimate monthly payments based on different loan amounts and interest rates.

- Credit Counseling: Access to credit counseling services can guide you in rebuilding your credit score while responsibly managing loans.

These resources empower you to navigate the lending landscape with confidence. By leveraging them, you can make informed decisions that suit your financial needs. Whether you're looking for personal loans or installment loans, local lenders are committed to supporting your journey. With competitive interest rates and quick approval processes, they aim to ensure you feel welcomed and understood as you pursue your financial goals.

Frequently Asked Questions

Which Lending Company Is the Best?

Determining the best lending company depends on your needs. A comparison guide can help you evaluate interest rates, terms, and services. Consider what's most important to you, and you'll find the right fit.

Conclusion

To sum up, finding the right loan lender in the Rio Grande Valley can have a profound impact on your financial journey. With average approval times ranging from 24 to 72 hours, you can access funds quickly when needed. Surprisingly, nearly 60% of borrowers prioritize personalized service over interest rates when choosing a lender. This underscores the significance of building relationships with lenders who understand your unique needs. By exploring the available options, you're better equipped to make informed financial decisions.