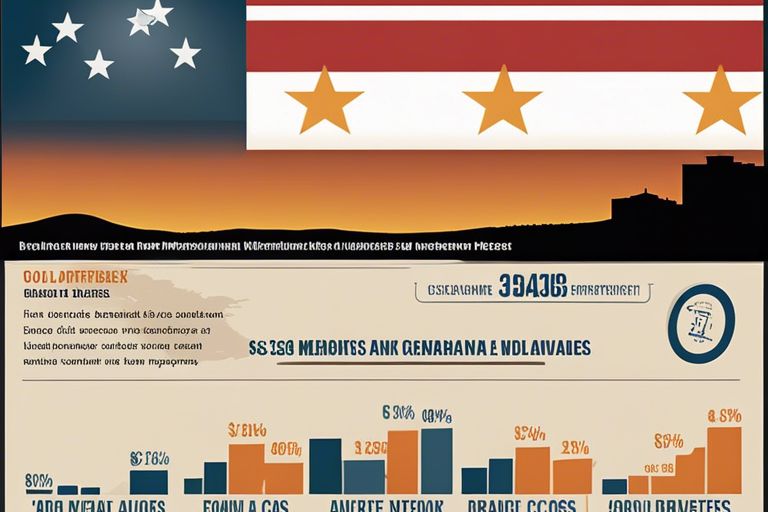

Texas RGV 1Restaurant financing options

It’s vital for you to explore diverse financing options available for your restaurant in the Texas Rio Grande Valley (RGV). Understanding these opportunities can help you effectively manage start-up costs, operational expenses, and expansions. From traditional bank loans to smaller, community-focused lending programs, having a comprehensive grasp of what’s available will empower you to make […]

MCA funding with no personal credit check RGV Tx

Most small business owners in the RGV area often find themselves in need of quick financing, but may be hesitant due to concerns over personal credit checks. Understanding how Merchant Cash Advances (MCA) work without impacting your personal credit score is crucial for making informed financial decisions. In this post, you will discover how MCA […]

Texas RGV Cost of merchant cash advance compared to traditional loans

RGV businesses often face tough decisions when it comes to financing options, especially when weighing the costs of merchant cash advances against traditional loans. Understanding the differences in terms of fees, repayment structures, and overall costs can be crucial for your financial health. In this blog post, you’ll discover the implications of choosing a merchant […]

High-risk business loans RGV Tx

Over the past few years, securing funding for your business in the RGV area has been increasingly challenging, especially if you fall under the high-risk category. Many traditional lenders may shy away from your application, but several alternative options are available that cater specifically to your needs. In this article, you will discover vital information […]

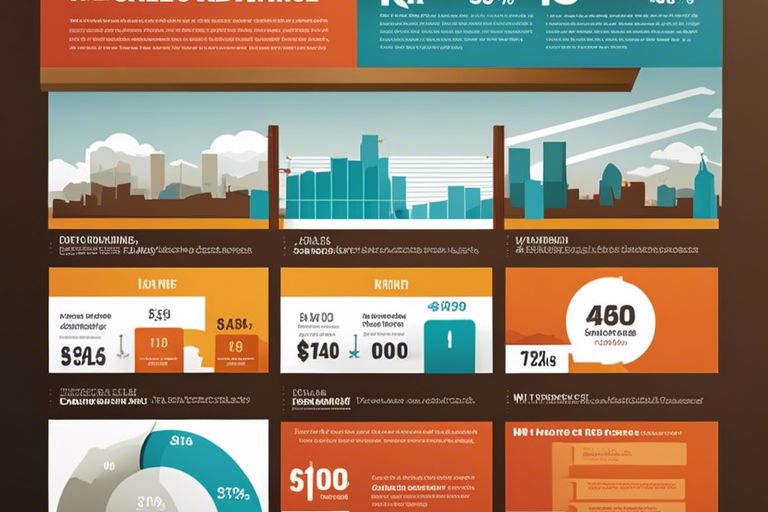

Understanding the Interest Rate Landscape for Long-Term Loans in RGV

It’s imperative to navigate the complex interest rate landscape when considering long-term loans in the Rio Grande Valley (RGV). With fluctuating rates influenced by economic factors and local market trends, understanding these dynamics can significantly impact your financial decisions. Whether you plan to invest in property, fund education, or secure a personal loan, grasping how […]

1Restaurant financing options Rio Grande Valley

There’s a myriad of financing options available for restaurant owners in the Rio Grande Valley, tailored to meet your specific needs and challenges. Whether you’re looking to start a new venture, expand an existing location, or simply improve cash flow, understanding these financial avenues can empower you to make informed decisions. From traditional loans to […]

Daily sales report MCA loans Rio Grande Valley

Loans play a crucial role in your financial planning, especially when it comes to Merchant Cash Advances (MCA) in the Rio Grande Valley. Understanding the daily sales report for MCA loans can significantly impact your business decisions, enabling you to track your progress and identify trends in your sales performance. In this blog post, you […]

Short-term merchant loans Rio Grande Valley

Many small business owners in the Rio Grande Valley find themselves in need of quick funding to seize opportunities or manage cash flow gaps. Short-term merchant loans offer a flexible financing solution tailored to your unique business needs, allowing you to access capital quickly without the lengthy approval processes associated with traditional loans. In this […]