You can take control of your financial future by implementing effective debt management strategies tailored for long-term borrowers in the Rio Grande Valley (RGV). Understanding your options and the unique economic landscape of the region can empower you to make informed decisions. From organizing your debts to exploring local resources, this blog post will guide you through imperative techniques to manage your debt effectively and pave the way for lasting financial stability.

Understanding Debt Management

Definition of Debt Management

The term “debt management” refers to the strategies and techniques employed to handle your debts effectively. This includes assessing your current debt situation, budgeting, negotiating with creditors, and creating a repayment plan that suits your financial circumstances. By implementing effective debt management practices, you can maintain control over your financial obligations and work towards reducing debt over the long term.

With an understanding of what debt management entails, you can take proactive steps to mitigate stress and financial strain. Effective debt management not only helps you stay current on your payments but also minimizes the overall cost of your debts by preventing late fees and reducing interest charges through timely repayments.

Importance of Effective Debt Management

Any long-term borrower can attest to the importance of effectively managing their debts for maintaining financial stability. When you master debt management techniques, you reduce your financial stress, which can lead to improved mental health and overall well-being. Additionally, effective management of your debts can enhance your credit score, making it easier for you to access favorable terms for future loans and financial products.

Importance cannot be overstated, as a well-structured debt management strategy helps you prioritize your financial obligations and allocate your resources more efficiently. When you understand your debts and the best ways to manage them, you can develop a clearer financial picture, setting yourself up for a more secure and successful financial future.

Common Challenges Faced by Long-Term Borrowers

Understanding the common challenges that you might encounter as a long-term borrower is crucial for effective debt management. Many long-term borrowers struggle with rising interest rates, unexpected expenses, and fluctuating income, which can make it increasingly difficult to maintain a steady repayment schedule. Additionally, feelings of hopelessness or frustration can lead to poor decision-making regarding your finances.

The challenges you face as a long-term borrower may also stem from balancing multiple debts, which can create confusion and impede your ability to focus on repayment strategies. Moreover, the emotional burden associated with ongoing debt can diminish your motivation to tackle repayment, potentially leading to a cycle of debt that feels impossible to break.

The reality is that many borrowers face similar struggles. Understanding these common challenges can empower you to develop a tailored approach to debt management that acknowledges your unique situation, making you better equipped to navigate your financial journey.

Assessing Your Financial Situation

Even though it may feel overwhelming, taking the time to assess your financial situation is crucial for successful debt management. Understanding where you stand financially enables you to make informed decisions moving forward. A clear picture of your finances not only includes your existing debts but also encompasses your income sources and important expenses. Proper assessment allows you to create a targeted strategy for repaying debt while ensuring that you can still meet your obligations on a day-to-day basis.

Analyzing Current Debt Levels

Assessing your current debt levels is the first step in your analysis. Take inventory of all your debts, including credit cards, loans, and any outstanding bills. Note the total amount owed, interest rates, and minimum monthly payments associated with each. By compiling this information, you can identify where most of your financial burden lies and strategize accordingly. Understanding the various types of debt—revolving (like credit cards) and installment (like personal loans)—will help you prioritize which debts to tackle first.

A thorough analysis of your debt also involves reviewing your payment history. Look for patterns in your repayments and any missed or late payments, as these can impact your credit score and overall financial health. Such insights can help you discover areas where you might be able to improve your payment habits, as well as fund allocation opportunities for increased debt repayment.

Evaluating Income Sources

On the other side of the equation lies your income sources. Scrutinize your earnings from employment, side jobs, investments, or any financial assistance you may receive. It’s important to determine your gross income as well as your net income after taxes and deductions. This clarity will guide you in evaluating how much money you have available to allocate toward debt repayment each month.

Having a comprehensive understanding of your income sources can also help you identify opportunities for additional revenue. Whether it’s asking for a raise, pursuing freelance work, or investing in further education to enhance your skills, increasing your income can provide the financial cushion you need to manage your debts more effectively.

This aspect of evaluating your income sources is crucial, as it lays the foundation for producing a stable budget. Your income can fluctuate due to various factors, including job security or unexpected expenses. Regularly revisiting this evaluation can keep you informed about your financial health and allow you to adjust your debt management strategies accordingly.

Identifying Necessary Expenses

For you to successfully manage your debt, it is critical that you identify your necessary expenses. Create a detailed list of your monthly expenses, categorizing them into important (like housing, utilities, and groceries) and discretionary spending (such as entertainment and dining out). This list will help you to see where your money is going each month, making it easier to identify areas where you can cut back to free up additional funds for debt repayment.

Additionally, understanding your necessary expenses can aid you in developing a realistic budget that prioritizes your financial obligations. You may find that certain discretionary expenses can be temporarily minimized or eliminated entirely to direct more funds toward paying down your debts, making your financial landscape more manageable in the long run.

Sources of information about necessary expenses can include tracking your spending habits over a month or two, reviewing bank statements, and using budgeting apps to categorize your expenditures. By continually monitoring these necessary expenses, you can make more informed choices that align with your financial goals and ultimately contribute to more effective debt management.

Creating a Debt Repayment Plan

Now that you understand the importance of effective debt management, it’s crucial to develop a structured debt repayment plan tailored to your unique financial situation. A well-crafted plan will not only help you regain your financial footing but also empower you to tackle your debts with confidence. Breaking down the process into manageable steps allows you to approach your repayment journey systematically, making it less daunting and more achievable over time.

Setting Realistic Financial Goals

On your path to becoming debt-free, setting realistic financial goals is important. Start by assessing your current financial situation, including your income, expenses, and total debt. This helps you develop achievable goals that align with your lifestyle and financial capabilities. For example, instead of aiming to pay off all your debts in a short time frame, consider focusing on paying off a specific amount each month that fits comfortably into your budget.

By setting small, incremental goals, you will keep yourself motivated and encouraged as you progress. Regularly reviewing and adjusting these goals as necessary will also ensure they remain aligned with any changes in your financial circumstances. Celebrate your milestones, no matter how small, as each step brings you closer to financial freedom.

Prioritizing Debts Based on Interest Rates

Repayment strategies vary, but a common and effective approach is to prioritize debts based on interest rates. By focusing first on high-interest debts, you can save money in the long run, as these debts tend to accumulate interest faster than others. Consider using a spreadsheet or budgeting app to keep track of your debts, including their outstanding balances and interest rates. This will help you clearly see which debts demand your immediate attention.

The debt avalanche method is particularly beneficial here, where you pay the minimum on all your debts except for the one with the highest interest rate. Put any extra funds toward the high-interest debt until it’s paid off. Once cleared, move on to the next highest-interest loan. This strategy minimizes the overall interest paid and accelerates your journey to debt freedom.

Choosing the Right Repayment Strategy

Creating a repayment strategy that aligns with your financial goals and personal circumstances is vital in managing your debts effectively. You can choose between strategies like the debt snowball method—where you focus on the smallest debts first—to build momentum quickly. Alternatively, consider the debt avalanche method, which targets debts with higher interest rates to save you money in the long run. Weigh the pros and cons of each approach to find what motivates you the most and fits your lifestyle.

Debts can feel overwhelming, but understanding the various repayment strategies can help you make informed decisions. Take the time to assess your situation and test different methods to see what works best for you. The key is persistence and adaptability, as you may need to refine your strategy along the way to ensure it continues to meet your evolving financial needs.

Exploring Debt Consolidation Options

All borrowers face the challenge of managing their debts, and if you’re among those in the RGV area, you might find that exploring debt consolidation options can be a beneficial strategy. This approach allows you to combine multiple debts into a single loan, simplifying payments and often reducing interest rates. For a deeper look into debt management, you can check out Mastering Debt Management: Your Blueprint to Financial …. By consolidating your debts, you can work towards regaining control over your finances, making it easier to plan for the future.

Types of Debt Consolidation

Debt consolidation can take several forms, each suitable for different financial situations. Here are some of the options you might consider:

| Debt Consolidation Loan | A personal loan used to pay off multiple debts, usually at a lower interest rate. |

| Home Equity Loan | Borrow against your home’s equity to pay off debts, often with tax benefits. |

| Balance Transfer Credit Card | Transfer high-interest credit card balances to a new card with 0% introductory rates. |

| Debt Management Plan (DMP) | A structured repayment plan negotiated with your creditors through a credit counseling agency. |

| Debt Settlement | Offer creditors a lump-sum payment to settle debts for less than you owe. |

Recognizing the type of debt consolidation that aligns with your financial goals is crucial. Each method has unique benefits and requirements, so it’s imperative to weigh your options carefully.

Pros and Cons of Debt Consolidation

Exploring the advantages and disadvantages of debt consolidation is vital before making a decision. Debt consolidation can help streamline your payments and potentially lower interest rates, but it’s important to fully understand the implications. Here’s a breakdown to consider:

Pros and Cons of Debt Consolidation

| Pros | Cons |

| Simplifies payments into a single monthly installment. | May lead to longer repayment periods. |

| Can reduce monthly payments. | Requires a good credit score to qualify for the best rates. |

| May lower your overall interest rates. | Could involve fees associated with loans or credit cards. |

| Offers potential tax benefits (with home equity loans). | Doesn’t address the underlying spending habits. |

| Improves credit score if managed well. | Risk of falling into a debt trap if relying on new credit. |

Pros and cons are imperative to understanding how debt consolidation affects your financial landscape. Evaluate your personal situation comprehensively to make the best choice for your needs.

How to Find the Right Debt Consolidation Loan

Debt consolidation isn’t a one-size-fits-all solution; finding the right loan requires careful consideration. Start by assessing your current debts and calculating how much you need to consolidate. Research various lenders and compare interest rates, fees, and terms. Look for loans with no origination fees and favorable amortization schedules, as these can impact your overall costs.

Understanding what features are most important to you can lead to better decision-making. Online calculators and financial advisors can also be valuable tools in determining your budget and understanding the total cost of consolidation. Always ensure you read the fine print before committing to any agreements to avoid unwarranted surprises.

Leveraging Credit Counseling Services

Your journey toward effective debt management can significantly benefit from leveraging credit counseling services. These services provide you with the knowledge and tools necessary to navigate your financial challenges. By working with trained professionals, you can develop a tailored plan to optimize your debt repayment strategies, which is particularly crucial for long-term borrowers like yourself in the RGV area.

What is Credit Counseling?

What you may not realize is that credit counseling is a process in which you collaborate with certified professionals to assess your financial situation comprehensively. This service includes reviewing your income, expenses, debts, and overall financial health. The goal is to establish a clear understanding of your finances and to create a personalized action plan to help you achieve your financial goals.

Credit counselors can also provide you with valuable resources, education, and support to help you manage your debt effectively. They may assist you in understanding various debt repayment options, including debt management plans, negotiating with creditors, and improving your budgeting skills. This collaborative approach ensures that you feel supported throughout your debt management journey.

Benefits of Seeking Professional Help

Benefits of seeking professional help through credit counseling services are manifold. First and foremost, these services can offer an objective perspective on your financial situation, helping you make informed decisions about your debt management strategies. Additionally, credit counselors can negotiate with creditors on your behalf, potentially resulting in lower interest rates or more favorable repayment terms.

With the support of a credit counselor, you can gain access to educational resources that enhance your financial literacy. This knowledge empowers you to make more strategic financial decisions in the future, ensuring that you are better equipped to avoid falling into debt traps again. Overall, engaging with a credit counseling service can drastically improve your financial outlook and provide you with the support needed to regain control of your finances.

Choosing a Reputable Credit Counseling Agency

The process of choosing a reputable credit counseling agency is crucial to your long-term financial success. Begin by researching various agencies in your area and verify that they are accredited by recognized organizations, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Review online ratings and testimonials to assess the reputation of each potential agency, and don’t hesitate to reach out for initial consultations to gauge their expertise and approach.

Professional credit counseling can make a significant difference in your debt management journey. A trustworthy agency will prioritize your best interests, providing transparent information about fees and services while complying with all applicable regulations. This ensures that you receive effective guidance tailored to your unique financial position, ultimately helping you navigate toward improved financial stability.

Building Better Financial Habits

Despite the challenges that come with being a long-term borrower, cultivating strong financial habits can significantly enhance your debt management strategy. Establishing a solid foundation of financial knowledge and discipline allows you to navigate your commitments with increasing confidence. By taking actionable steps toward better financial practices, you not only create a pathway to paying off debt but also lay the groundwork for a more secure financial future.

Creating a Budget

Better management of your finances begins with creating a budget. A budget acts as a blueprint for your financial journey, allowing you to allocate your income toward vital expenses, debt repayments, and savings effectively. Start by tracking your monthly income and list all your expenses, categorized by necessities and discretionary spending. This clarity enables you to make informed decisions about where to cut back or how to prioritize your financial obligations.

When your budget is in place, ensure that you revisit and adjust it regularly. Life circumstances change, and so do expenses. By reviewing your budget periodically, you can identify spending patterns, recognize areas that need adjustment, and when possible, allocate more funds towards paying off debts or increasing your savings. The process of budgeting may initially seem tedious, but over time it becomes an invaluable tool for regaining control over your financial future.

Saving for Emergencies

Better preparation for unexpected financial emergencies can spare you from falling deeper into debt. Establishing an emergency fund allows you to cover unforeseen expenses without having to rely on high-interest loans or credit cards, which can lead to a cycle of financial instability. Aim to set aside a modest amount every month until you reach your savings goal, whether it’s three to six months’ worth of living expenses. This safety net provides peace of mind, encouraging you to pursue long-term financial goals without the constant worry of sudden costs derailing your progress.

For instance, if your car breaks down or you face an unexpected medical bill, having funds in your emergency savings can help you manage these challenges without sacrificing your budget. This proactive approach not only minimizes financial strain but also reinforces the habit of saving, which is vital for long-term financial health.

Tracking Spending Patterns

Financial awareness is crucial for establishing and maintaining good habits. By tracking your spending patterns, you can identify where your money is going and spot areas where you may be overspending. Utilize apps or spreadsheets to monitor your transactions, and categorize them to see which areas you can adjust. This mindfulness allows you to align your spending with your financial goals, ultimately aiding in quicker debt repayment and improved financial wellness.

When you start tracking your spending, you’ll often find unexpected surprises in your financial habits. For example, you might realize that frequent small purchases add up significantly over a month. Recognizing these patterns helps you make more informed choices about how you spend your money, which in turn strengthens your commitment to your budget and savings goals.

Plus, by regularly assessing your spending patterns, you enhance your ability to make informed financial decisions. This proactive approach allows you to adjust your habits as needed, ensuring that your lifestyle remains within your means. As you become more aware of your spending, you’ll find that you can allocate more resources toward paying off debts and achieving your financial goals, making your journey toward financial stability more attainable.

Utilizing Financial Tools and Resources

For long-term borrowers in the RGV, effectively managing debt requires more than just discipline; it also involves leveraging the right financial tools and resources. By utilizing technology and educational programs, you can enhance your financial literacy and create a more structured approach to repayment. This chapter will explore various financial tools, budgeting apps, educational programs, and community resources available to you as a resident of the Rio Grande Valley.

Budgeting Apps and Software

Financial management has been revolutionized by budgeting apps and software that provide an easy way for you to track your expenses, create budgets, and monitor your debt repayment progress. With these tools at your fingertips, you can easily categorize your spending, set financial goals, and receive alerts to help you stay on track. Most budgeting apps allow you to input your income and expenses, giving you a clearer picture of your financial situation and enabling you to make informed decisions about your debt repayment strategy.

Moreover, many of these budgeting tools can sync with your bank accounts, providing real-time updates on your financial activity. This feature not only helps you visualize your spending habits but also encourages accountability to meet your financial commitments. By using budgeting apps, you can create a personalized plan that suits your lifestyle and debt levels, optimizing your route to financial stability.

Financial Education Programs

Budgeting education is crucial for anyone seeking to better manage their debt, and financial education programs are widely available to help you gain a deeper understanding of money management strategies. These programs often cover various topics, including budgeting techniques, credit management, and responsible borrowing. By attending workshops or online classes, you empower yourself with the knowledge needed to make better fiscal decisions moving forward, which can ultimately ease your long-term borrowing burdens.

Many organizations and community colleges in the RGV offer financial education classes, often free or at a low cost, tailored specifically for individuals facing debt challenges. Engaging in these programs not only helps you learn effective strategies for managing your finances but also connects you with other community members facing similar challenges, fostering opportunities for support and shared learning.

Community Resources in RGV

The Rio Grande Valley is rich with community resources dedicated to assisting borrowers like you in managing debt more effectively. Local nonprofits and financial institutions offer services such as credit counseling, workshops, and even one-on-one consultations. By taking advantage of these initiatives, you can receive tailored advice that suits your specific financial situation, as well as access to valuable informational resources.

Many of these community resources also provide access to helpful literature, financial calculators, and online courses that can further your understanding of debt management. Utilizing these local resources can significantly bolster your efforts in creating a sustainable financial future, making you feel more competent and confident in your decision-making.

With the right tools and support systems in place, you can effectively manage and mitigate the stress associated with long-term borrowing in the RGV. Leveraging budgeting apps, pursuing financial education, and engaging with community resources are crucial steps towards achieving your financial goals and attaining long-lasting stability.

To Wrap Up

Summing up, effective debt management strategies are crucial for long-term borrowers in the RGV. By assessing your financial situation, creating a structured budget, and prioritizing your debts, you can bolster your financial stability while reducing the stress that comes with borrowing. Make it a habit to regularly review your credit report, as well as your borrowing and repayment history, to identify areas for improvement. Utilizing resources such as the Internal Lending Program | The University of Texas … can provide additional options and insights to help you manage your debts more effectively.

Furthermore, don’t underestimate the value of seeking professional advice when necessary. Consulting with financial analysts or debt counselors can help you tailor a strategy that aligns with your specific situation and long-term goals. Be mindful of, managing debt doesn’t just alleviate immediate pressures; it positions you for a more secure financial future. By implementing these effective strategies, you can take control of your financial journey and work towards achieving greater economic well-being.

FAQ

Q: What are the most effective debt management strategies for long-term borrowers in RGV?

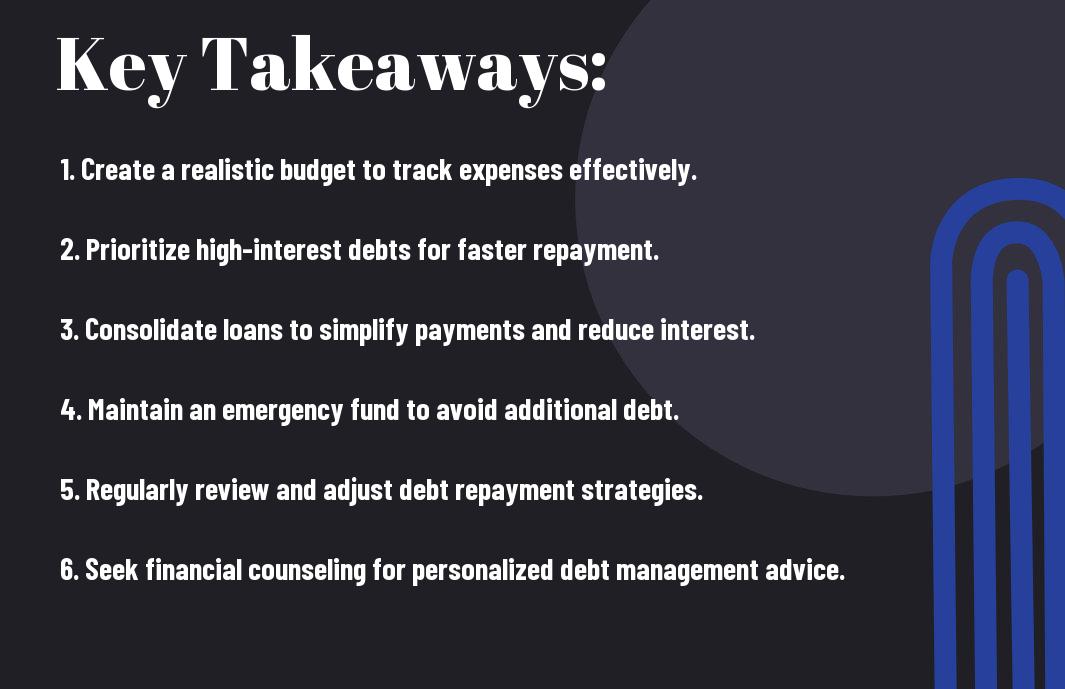

A: Effective debt management strategies for long-term borrowers in the Rio Grande Valley (RGV) include creating a detailed budget to track income and expenses, prioritizing debt repayment by focusing on high-interest debts first, consolidating debts to simplify payments and potentially lower interest rates, and regularly reviewing financial goals to stay on track. Building an emergency savings fund can also provide a buffer against unexpected expenses, helping to prevent new debt from accumulating.

Q: How can borrowers in RGV improve their credit scores while managing existing debt?

A: Borrowers in RGV can improve their credit scores by making timely payments on all debts, reducing overall credit utilization by paying down credit card balances, avoiding new credit inquiries unless necessary, and disputing any errors on their credit reports. Additionally, borrowers are encouraged to maintain a varied credit mix, such as installment loans and revolving credit, as a healthy credit profile can positively impact their scores.

Q: Are there specific resources available in RGV for debt management assistance?

A: Yes, in RGV, there are several resources available for debt management assistance. Local credit counseling agencies provide free or low-cost workshops and one-on-one counseling sessions to help borrowers understand their financial situation and develop a personalized debt management plan. Community organizations, such as VIDA, and financial institutions often offer workshops on budgeting and money management that can be beneficial for long-term borrowers.

Q: What steps should borrowers take if they are unable to meet monthly debt obligations?

A: If borrowers are unable to meet monthly debt obligations, they should first assess their financial situation and identify the reasons for the shortfall. It is crucial to reach out to creditors to negotiate payment plans or lower interest rates. Exploring options like debt consolidation or speaking with a credit counselor for professional advice can also help. In addition, borrowers may consider temporary measures such as reducing discretionary spending or finding additional sources of income to alleviate financial strain.

Q: How can long-term borrowers in RGV prepare for future financial challenges related to debt?

A: Long-term borrowers in RGV can prepare for future financial challenges by creating a comprehensive financial plan that includes elements such as maintaining a budget, building an emergency savings fund, and regularly monitoring their credit. They should also educate themselves about money management principles, set attainable financial goals, and consider diversifying their income streams. Proactively addressing these areas can help mitigate the impact of unexpected financial challenges in the future.