There’s a wealth of opportunities waiting for you in home equity loans, especially as a homeowner in the vibrant Rio Grande Valley. This guide is designed to provide you with all the imperative information you need to understand how these loans work, their benefits, and what to consider before making a decision. By the end of this post, you’ll be equipped with the knowledge to tap into the equity of your home strategically and confidently, potentially opening doors to new financial possibilities.

Understanding Home Equity Loans

Definition and Overview

Your home is not just a place to live; it’s also a significant financial asset. A home equity loan is a type of loan that allows you to borrow against the equity you’ve built in your home. Home equity is defined as the difference between your home’s current market value and the outstanding balance on your mortgage. By utilizing this equity, you can access funds for major expenses, such as home renovations, debt consolidation, or unexpected medical bills.

The process of securing a home equity loan typically involves applying through a lender, who will assess your equity, creditworthiness, and financial situation. If approved, you will receive a lump sum payment that you will need to repay over a specified period, including interest. Understanding the terms and conditions of your loan is vital to ensure it aligns with your financial goals.

How Home Equity Loans Work

Work in a home equity loan begins with an assessment of your equity, which will determine how much you can borrow. Lenders generally require you to have a minimum amount of equity—usually at least 15% to 20% of your home’s value—before they will approve a loan. The amount you can borrow is typically capped at 85% of your home’s appraised value, minus any outstanding mortgage balances.

Once your application is approved, the funds are often disbursed as a lump sum. You’ll then make fixed monthly payments over the life of the loan, which can range from five to twenty years, depending on your lender’s terms. This predictability in repayment makes home equity loans an attractive option for those who prefer stability in their monthly financial obligations.

To ensure you are making the most of your home equity, be prudent in assessing why you are borrowing and how the funds will be utilized. Taking out a home equity loan for investments that yield high returns can be a smart move; however, using it for discretionary spending may not always be the best financial decision.

Key Terminology

The realm of home equity loans comes with its fair share of terminology that is vital to understand. Key terms include “equity,” which refers to the portion of your home that you truly own; “loan-to-value ratio” (LTV), which is a measurement used by lenders to determine the risk of lending you money; and “fixed vs. variable interest rates,” which indicates whether your loan’s interest rate will remain constant throughout the term or change over time. Familiarizing yourself with these terms will empower you as you navigate the home equity loan landscape.

Understanding these key terms can also help you make more informed decisions regarding loan options, as different lenders may use them variably. This comprehension not only aids you in discussions with lenders but also ensures you can shop around and obtain the best terms suited to your financial circumstances.

Terminology related to home equity loans can sometimes be complex, but being well-versed in it will allow you to better communicate with lenders and make informed choices. Accessing this knowledge can ultimately save you time, money, and stress as you initiate on your financial journey.

Types of Home Equity Loans

You may be considering tapping into the equity you have built in your home and may have come across different options. Understanding the types of home equity loans available can help you make an informed decision that suits your financial needs. Here is a brief overview of the types of home equity loans you can explore:

- Traditional Home Equity Loans

- Home Equity Lines of Credit (HELOCs)

- Cash-Out Refinancing

Recognizing the features of each type can greatly impact your choice and financial strategy.

| Type | Description |

|---|---|

| Traditional Home Equity Loans | A fixed amount borrowed against your home equity at a set interest rate. |

| HELOCs | A revolving line of credit based on your home equity that you can draw from as needed. |

| Cash-Out Refinancing | Refinancing your mortgage for more than you owe to access cash for various expenses. |

Traditional Home Equity Loans

Any homeowner can consider a traditional home equity loan if they want a lump sum of money for a specific purpose, such as consolidating debt, funding a major purchase, or making home improvements. This type of loan typically offers a fixed interest rate and a fixed payment term, usually ranging from 5 to 30 years. This allows you to have predictable monthly payments, making it easier to budget.

The approval process for traditional loans often involves a thorough credit check and appraisal of your home to determine its current market value. Generally, lenders prefer that you retain a loan-to-value ratio that doesn’t exceed 85%, ensuring you have a reasonable amount of equity to secure the loan against.

Home Equity Lines of Credit (HELOCs)

Home equity lines of credit (HELOCs) are another popular choice for homeowners looking to tap into their home equity. Unlike a traditional home equity loan, a HELOC functions more like a credit card, allowing you to borrow against your home’s value up to a predetermined limit. You can draw funds as needed during the draw period, typically lasting 5 to 10 years, and you only pay interest on the amount you borrow.

During the repayment period, you will start making payments towards both principal and interest, and HELOCs often come with variable interest rates that can change with market fluctuations. This feature allows for flexibility in managing your finances, especially if you anticipate needing access to cash at different times throughout the year.

A HELOC can be an excellent choice if you prefer to borrow as required rather than committing to a fixed amount upfront.

Cash-Out Refinancing

HELOCs can be an attractive option, but you might also consider cash-out refinancing if you’re looking to take advantage of lower mortgage rates while accessing your home’s equity. Cash-out refinancing involves replacing your existing mortgage with a new, larger one, allowing you to withdraw the difference in cash. This can provide you with a substantial amount of money for home renovations, debt consolidation, or other financial needs.

It’s important to evaluate the terms of your new mortgage because while you can access needed cash, you might accrue additional interest. By keeping an eye on the market, you can potentially secure a better interest rate than the one on your existing mortgage, making the overall financial picture more appealing.

For instance, if you initially took out a mortgage at a higher interest rate, and the current market rate has dropped, cash-out refinancing not only allows you to access cash but also reduces your overall borrowing costs.

Factors to Consider Before Applying

All homeowners in the Rio Grande Valley should carefully evaluate several factors before deciding to apply for a home equity loan. Understanding these elements will help you make an informed decision and ensure that you’re choosing the right loan option for your financial circumstances. Below are some critical factors to keep in mind:

- Your home’s equity

- Credit score requirements

- Interest rates and terms

- Loan fees and closing costs

Thou should take the time to analyze each of these factors in detail before proceeding with your application.

Your Home’s Equity

An crucial aspect to consider when applying for a home equity loan is the equity you have accrued in your home. Home equity is the difference between the current market value of your property and the outstanding balance on your mortgage. Generally, lenders allow you to borrow against a percentage of your equity, often up to 80% or even more, depending on their policies. Knowing your current equity can help you determine how much you qualify for and how it can impact your financial goals.

Additionally, keep in mind that home values can fluctuate due to market conditions. Therefore, assessing the current value of your home through a professional appraisal or a comparative market analysis is advisable. This insight will not only inform you of your available equity but also guide you in making a well-rounded decision regarding the loan amount you might need and can reasonably afford.

Credit Score Requirements

Little do many homeowners realize that their credit score plays a significant role in determining their eligibility for a home equity loan. Lenders often set certain minimum credit score requirements, typically ranging between 620 to 700. A higher score can facilitate better terms, including lower interest rates and more favorable repayment options. If your credit score falls below the required threshold, it might limit your borrowing ability or result in higher fees and rates.

Furthermore, it’s advisable to check your credit report for any inaccuracies that could adversely affect your score. Taking the time to improve your credit score, such as by paying down existing debts or making timely payments, can significantly enhance your chances of obtaining a favorable home equity loan.

The importance of your credit score cannot be overstated, as it gives lenders an insight into your financial responsibility. It serves as a risk assessment tool, allowing them to gauge how likely you are to repay the loan. Ensuring your credit score is in good standing before applying will not only improve your chances of approval but may also save you a substantial amount of money in interest over the long run.

Interest Rates and Terms

For Rio Grande Valley homeowners considering a home equity loan, understanding interest rates and terms is crucial. Home equity loans typically have fixed interest rates, ensuring that your monthly payments remain consistent throughout the loan’s life. It’s crucial to compare rates from different lenders to secure the best deal that aligns with your financial situation. Additionally, the duration of the loan can vary, with typical terms ranging from 5 to 30 years, depending on your preference and financial capabilities.

By carefully evaluating the interest rates and terms of your potential loan, you can better manage your budget while ensuring that your home equity loan works for you. Factors such as your creditworthiness, loan amount, and market conditions can influence rates, so being well-informed is key.

Interest rates can be influenced by broader economic factors, such as inflation and prevailing mortgage rates. Keeping an eye on economic trends can help you make timely and informed decisions regarding when to apply for a loan, ensuring you lock in a favorable rate.

Loan Fees and Closing Costs

Equity loans can come with various fees and closing costs that you’ll need to be prepared for. These can include application fees, appraisal fees, and attorney fees, among others. Understanding these costs upfront can help you budget effectively and avoid unexpected expenses during the loan process. Some lenders may offer to roll these costs into the loan amount, but this could lead to a higher overall debt.

When comparing different lenders, ensure to ask about all applicable fees and closing costs associated with the loan. Transparency about these charges will help you assess the total cost of borrowing, allowing you to evaluate which loan option is most economical.

Applying for a home equity loan involves understanding the potential fees associated with the process. By doing thorough research and asking for a detailed breakdown of all costs from your lender, you can make more informed decisions and minimize your out-of-pocket expenses.

Pros and Cons of Home Equity Loans

Unlike other financial options, home equity loans carry distinct advantages as well as significant risks. It is vital for you to weigh these pros and cons when considering whether a home equity loan is right for your financial situation. Below is a breakdown of the key advantages and disadvantages.

Pros and Cons of Home Equity Loans

| Pros | Cons |

|---|---|

| Lower interest rates compared to personal loans or credit cards | You risk losing your home if you default on the loan |

| Tax-deductible interest in some cases | Fees and closing costs can be high |

| Ability to borrow a significant amount of money | Increased overall debt burden |

| Fixed loan amounts and repayment periods offer predictability | Home equity loans can reduce your equity, making future financing harder |

| Suitable for large expenses like home renovations or college tuition | Potential for fluctuating interest rates in variable loans |

| Quick access to funds | Potential for lender fraud or scams |

| Utilizes the value already accumulated in your home | You may feel pressured to borrow more than you need |

Advantages of Home Equity Loans

Even if you’re cautious about taking on more debt, the advantages of home equity loans can be compelling. For one, they typically have lower interest rates compared to unsecured loans, making them an attractive option for financing larger expenses such as home improvements or education costs. Moreover, in many cases, the interest on a home equity loan may be tax-deductible, which can lead to considerable savings on your tax bill.

Another significant advantage is the fixed loan terms. With a home equity loan, you can lock in your interest rate and have a defined repayment schedule, giving you some predictability in your budgeting. This consistency can be especially beneficial if you are finance-savvy and appreciate knowing exactly how much you will owe each month, allowing for better financial planning.

Disadvantages and Risks

Even though there are advantages, you must also carefully consider the disadvantages and risks associated with home equity loans. One primary concern is the potential for foreclosure. Failing to repay your home equity loan can lead to severe consequences, such as losing your home. Also, the fees and closing costs associated with obtaining a home equity loan may be higher than you anticipate, which means your overall costs could add up quickly.

On top of that, taking out a home equity loan increases your overall debt burden. Managing multiple loans can be challenging, and if you are not careful, it could hinder your financial stability. Additionally, a decrease in home value could result in you owing more than your home is worth, complicating any future sales or refinancing options.

Home equity loans may offer a way to access cash quickly, but it’s crucial to evaluate your financial situation carefully. Ensuring you understand the potential repercussions can help you make an informed decision. For a more detailed overview, consider checking out A Comprehensive Guide About Home Equity Loans.

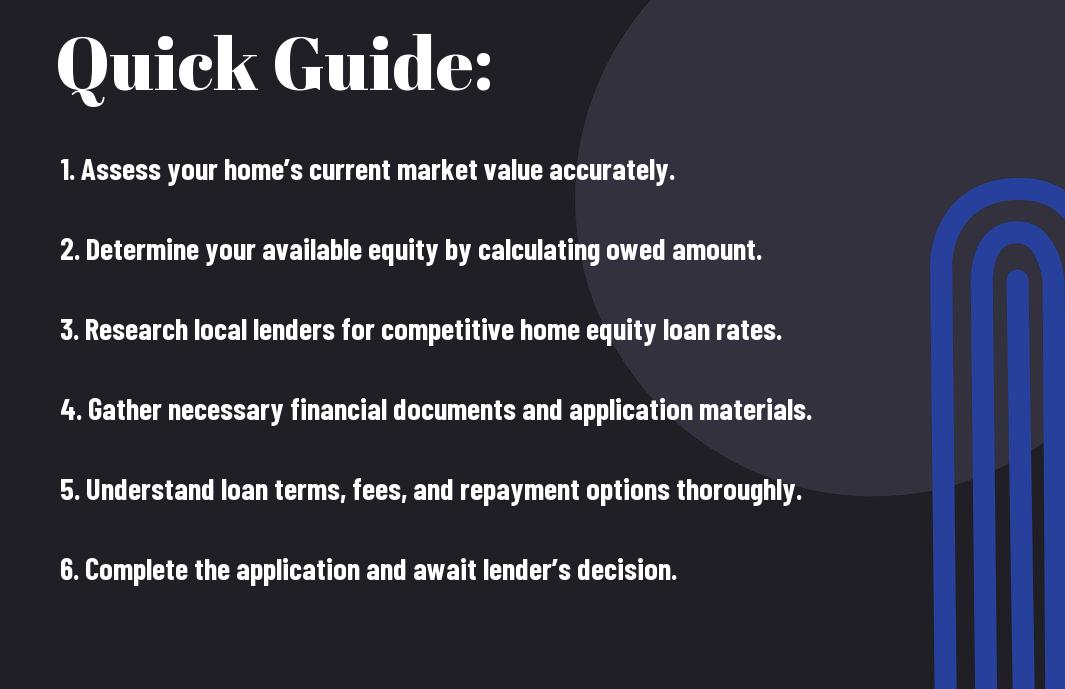

Step-by-Step Guide to Obtaining a Home Equity Loan

Now that you understand the benefits of home equity loans, it’s time to investigate into the process of obtaining one. This guide will walk you through each crucial step, from assessing your financial situation to closing the loan. Follow these steps to ensure you make informed decisions that align with your financial goals.

| Step | Description |

| 1. Assessing Your Financial Situation | Understand your credit score, debt-to-income ratio, and overall financial health. |

| 2. Shopping for Lenders | Compare offerings from various lenders to find the best terms and interest rates. |

| 3. Application Process Details | Gather required documents and complete the loan application. |

| 4. Closing the Loan | Finalize your loan agreement and receive the funds. |

Assessing Your Financial Situation

Even before you consider approaching lenders, it is crucial to take a close look at your financial situation. This involves evaluating your credit score, which can significantly impact the terms of your loan. Generally, a higher credit score will yield better repayment terms, including lower interest rates. Furthermore, you must assess your debt-to-income ratio, which is the proportion of your monthly income that goes towards paying debts. Lenders typically prefer this ratio to be below 43%.

Additionally, consider your overall financial health, including savings and existing obligations. If you have substantial debts or unstable income, it may be wise to wait before applying for a home equity loan. Your priority should be reaching a financial state where you can comfortably manage both your existing debts and the new loan payments.

Shopping for Lenders

An important step in the home equity loan process is shopping for lenders. It’s crucial to compare distinctive features of various lenders, including interest rates, fees, and loan terms. Some lenders may offer flexible payment options, while others might have stricter repayment policies. Ensure you assess not only the cost but also the customer service reviews of the lenders you are considering.

Your goal should be to find a lender that offers a competitive rate while also being responsive to your questions and concerns. Don’t hesitate to reach out to multiple lenders to get quotes and make side-by-side comparisons. This diligence can save you thousands over the life of the loan.

Application Process Details

Details regarding the application process can vary among lenders, but most require similar documentation. You should be prepared to provide proof of income, employment verification, tax returns, and details about your current debts and assets. Collecting these documents in advance will help streamline the process and avoid delays. Once your documents are collected, follow the lender’s instructions carefully when filling out the application.

With a thorough application in hand, your lender will likely order an appraisal to determine the current value of your home. The appraisal is crucial as it helps the lender understand how much equity you have available for borrowing. Proper preparation and understanding of this process will enhance your chances of loan approval.

Closing the Loan

Closing your home equity loan is the final step where all parties come together to execute and sign the loan agreement. During closing, you will review the terms of the loan, including the total amount borrowed, repayment schedule, and any fees associated with the loan. It’s vital to read all documents carefully to ensure you are comfortable with the terms before signing.

For instance, some lenders may require you to pay upfront fees or closing costs which can affect the total amount you receive. Being well-informed and asking clarifying questions will help mitigate any uncertainties. Once you sign the closing documents, you’ll typically receive your funds shortly afterward, allowing you to use your equity as intended.

Tips for Managing Your Home Equity Loan

Despite the many advantages that come with securing a home equity loan, managing it effectively is important to avoid potential pitfalls that could lead to financial strain. Proper management of your loan is vital not only to meet your repayment obligations but also to protect your financial health. Here are some useful tips to consider:

- Understand the terms of your loan thoroughly.

- Create a realistic budget that includes your payments.

- Make it a habit to pay more than the minimum when possible.

- Keep an eye on interest rates and market conditions.

- Consider refinancing options if rates drop significantly.

Knowing how to navigate your loan can save you money and ensure that your financial future remains secure. By being proactive, you’ll be better equipped to handle the responsibilities that come with borrowing against your home’s equity.

Budgeting for Loan Payments

Equity loans require a consistent payment schedule, which can impose additional financial responsibilities. Establishing a budget that incorporates your loan payments is crucial. Start by itemizing your monthly expenses and income to determine how much you can comfortably allocate towards your home equity loan. Pay special attention to other monthly financial obligations to avoid overextending your budget.

When budgeting, factor in possible interest rate fluctuations, especially if you have a variable-rate loan. As your interest could increase, leaving sufficient room in your budget allows you to manage higher payments without stress. Overall, maintaining discipline in your budgeting will not only help you avoid payment issues but can also lead to better financial health in the long term.

Avoiding Common Pitfalls

Payments on home equity loans can become overwhelming if not managed properly. Many borrowers underestimate the impact that these payments can have on their overall financial situation, leading to late fees and even default. To avoid these challenges, always keep accurate records of your payment schedules and due dates. Set up reminders or automate payments where feasible to ensure you never miss a deadline.

Your approach to managing debt should involve careful consideration of how each payment fits within your overall financial strategy. It’s important to remain vigilant about your loan’s implications on your credit score and your home’s equity. Regularly reviewing your financial situation will help you stay ahead of any potential issues and make necessary adjustments as needed.

Strategies for Paying Off Early

Avoiding the long-term financial commitment of a home equity loan can offer significant peace of mind. If you’re in a position to do so, consider strategies for paying off your loan early. This may include making extra payments when possible, such as using tax refunds, bonuses, or savings to chip away at the principal. Each additional payment you make can significantly reduce the total interest you will pay over the life of the loan.

Additionally, developing a clear repayment plan can help you stay on track and motivated. Setting milestones, whether it’s aiming to pay off a specific percentage of the loan within a set timeframe, can provide you with a sense of accomplishment and drive your repayment efforts. By consciously prioritizing your home equity loan payments, you’re ensuring a secure financial future.

Early repayments not only save you money in interest but also free up your finances for other investments or needs in the future. The sooner you can eliminate this debt, the sooner you can regain full equity in your home.

To wrap up

Summing up, understanding home equity loans is important for you as a Rio Grande Valley homeowner. These loans can provide a viable source of funding for various needs, such as home improvements, debt consolidation, or education expenses. By leveraging the equity in your home, you can gain access to lower interest rates and favorable repayment terms compared to other borrowing options. However, it is crucial to approach this financial product with caution, as it directly affects your home’s equity and financial future.

As you consider a home equity loan, it’s vital to evaluate your financial situation, compare lender offers, and understand the detailed terms and conditions. By equipping yourself with the knowledge from this comprehensive guide, you can make informed decisions that align with your financial goals. Being well-informed means you can confidently navigate the lending process, ensuring that you select the best option for your unique circumstances in the Rio Grande Valley.

FAQ

Q: What is a home equity loan and how does it work for Rio Grande Valley homeowners?

A: A home equity loan allows homeowners to borrow against the equity they have built up in their property. Home equity is the difference between the home’s current market value and the outstanding balance on the mortgage. For Rio Grande Valley homeowners, these loans can provide access to funds for renovations, debt consolidation, or other financial needs. Typically, the loan is secured by the home itself, and it comes with fixed interest rates and a set repayment term. It’s important for homeowners to assess their financial situation and ensure they can comfortably manage the loan repayment.

Q: What are the eligibility requirements for obtaining a home equity loan in the Rio Grande Valley?

A: To qualify for a home equity loan in the Rio Grande Valley, homeowners generally need to meet several criteria, including: being the owner of the home with sufficient equity, having a stable income, a good credit score (usually 620 or higher), and a low debt-to-income ratio. Lenders may also consider the home’s appraised value and their lending policies, which can vary. It’s advisable for potential borrowers to consult with a local lender to understand specific requirements that may apply.

Q: What are the potential risks associated with home equity loans?

A: While home equity loans can provide much-needed cash, they come with risks. The primary risk is that since the loan is secured by the home, failure to make timely payments could lead to foreclosure. Additionally, there’s the risk of over-leveraging, where homeowners might take on too much debt relative to their home value, especially if property values decrease. Homeowners should carefully evaluate their financial stability and consider consulting a financial advisor before committing to a home equity loan.

Q: How do interest rates for home equity loans in the Rio Grande Valley compare to other loan types?

A: Interest rates for home equity loans in the Rio Grande Valley typically tend to be lower than those for unsecured personal loans or credit cards since these loans are backed by the borrower’s home equity. However, rates can vary based on the lender, the homeowner’s creditworthiness, and current market conditions. It’s advisable for homeowners to shop around, compare rates, and possibly consult mortgage brokers to find the best option available for their specific needs.

Q: What are some common uses for home equity loans in the Rio Grande Valley?

A: Rio Grande Valley homeowners often use home equity loans for a variety of purposes, including home improvement projects, such as kitchen remodels or roof repairs, which can increase the property’s value; debt consolidation to lower monthly payments and simplify finances; paying for major expenses like college tuition; or funding large purchases. It’s crucial for homeowners to use these funds wisely and consider the long-term impact on their financial health.